Filed under Auto Insurance on

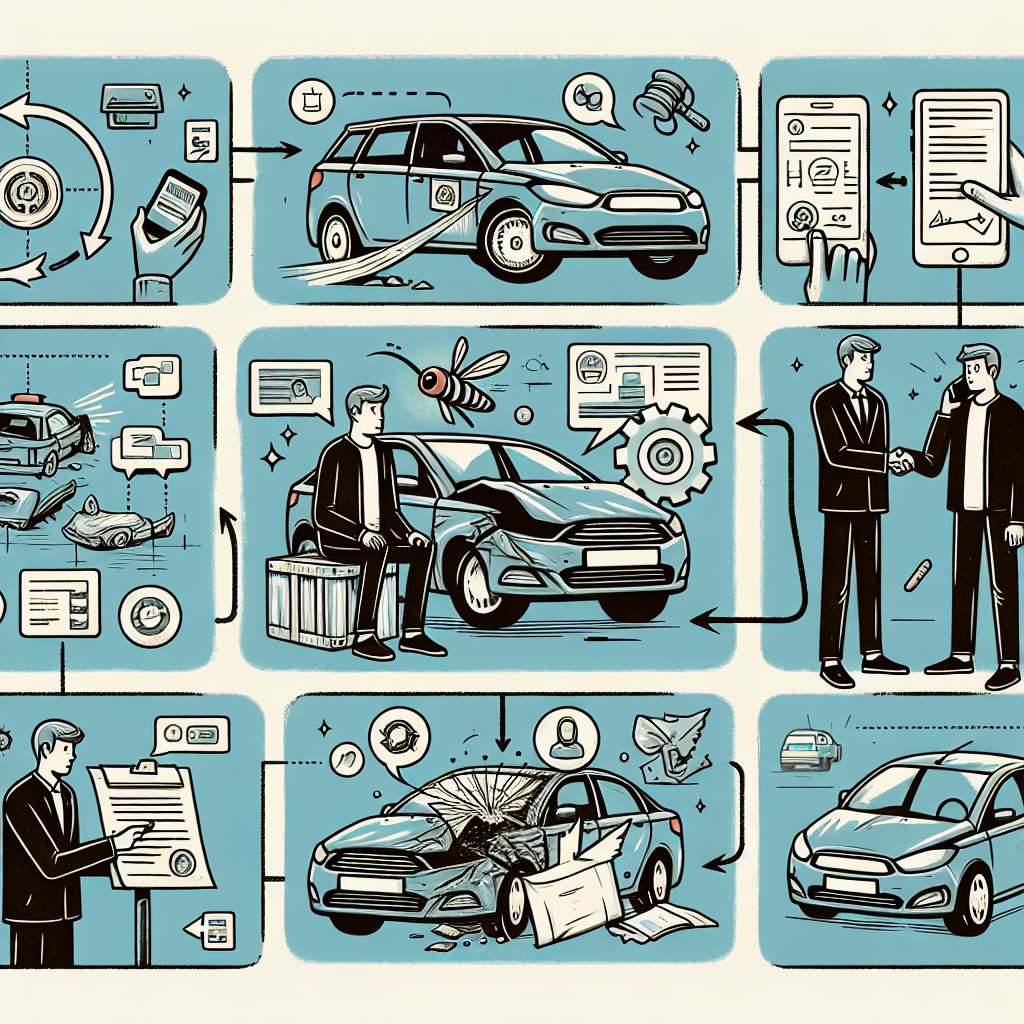

Auto Body Repair Insurance Claims: Step-by-Step Guide

Dealing with collision damage is stressful enough. Navigating the insurance process on top of that can feel overwhelming. The good news is that when you understand how auto body repair insurance claims work, you can protect your rights, avoid costly mistakes, and get your vehicle repaired properly and promptly.

This step-by-step guide walks you through the full journey—from the moment an accident happens to the day you pick up your repaired vehicle. Whether you’re dealing with a minor fender-bender or major collision damage, you’ll learn how to manage an auto body repair insurance claim with confidence and clarity.

Understanding Auto Body Repair Insurance Claims

Before you start any paperwork, it helps to understand what an auto body repair insurance claim actually is. In simple terms, it’s your formal request to an insurance company to cover the cost of repairing collision-related damage to your vehicle.

Depending on your policy and who is at fault, an auto body repair insurance claim may fall under:

Collision coverage – Pays to repair or replace your car after a collision with another vehicle or object, regardless of fault (after your deductible).

Liability coverage – If you are at fault, your liability coverage pays for the other driver’s damage and injuries, not your own repairs.

Uninsured/underinsured motorist property damage – Helps if the at-fault driver has little or no insurance.

Comprehensive coverage – Applies to non-collision damage (hail, falling objects, vandalism, theft); sometimes processed similarly to collision repairs.

Knowing which part of your policy applies to your auto body repair insurance claim will influence your deductible, your options, and whether you can recover additional costs such as rental cars or diminished value.

Step 1: Prioritize Safety and Document the Scene

The first phase of any claim starts at the accident scene. The choices you make in the first few minutes can strongly affect how smoothly your claim goes later.

Ensure Everyone Is Safe

Check yourself and passengers for injuries first.

If it’s safe, move vehicles out of traffic to a shoulder or parking lot.

Turn on hazard lights, and use cones or flares if available.

Call emergency services if anyone is injured or if vehicles are blocking traffic.

Call the Police and Request a Report

Even for seemingly minor collisions, it’s wise to contact law enforcement. A formal police report often becomes critical evidence in an auto body repair insurance claim, especially if fault is disputed or injuries surface later.

Stick to the facts: what happened, where, and when.

Avoid admitting fault or speculating about causes.

Ask how and when you can obtain a copy of the police report.

Capture Photos and Gather Information

Smartphone photos can be powerful tools when an adjuster evaluates your auto body repair insurance claim. Document as much as you reasonably can:

Overall scene from multiple angles.

Close-ups of all visible damage on every vehicle involved.

Skid marks, debris, road signs, intersection layouts, and weather conditions.

License plates and VIN stickers if accessible.

Exchange basic information with the other driver:

Full name and contact number.

Insurance company and policy number.

Driver’s license number (where permitted by law).

Vehicle make, model, year, and plate number.

If there are eyewitnesses, ask for their names and contact details. Neutral third-party statements often carry weight in disputed auto body repair insurance claims.

Step 2: Notify Your Insurance Company Promptly

Most policies require you to notify your insurer within a reasonable time after an accident. Delays can raise red flags or, in extreme cases, jeopardize coverage.

What to Have Ready When You Call

Your policy number.

Date, time, and location of the accident.

Names and insurance details of other drivers.

Police report number, if available.

Brief description of what happened and the known damage.

Stick to clear, factual statements. Your initial description will become part of the record for your auto body repair insurance claim.

Ask These Key Questions

To avoid confusion later, ask your claims representative:

Is my claim filed under collision, liability, or another coverage type?

What is my deductible, and how is it applied?

Do I have rental car reimbursement or towing coverage?

Do I have to use a preferred repair shop, or can I choose my own?

What are the next specific steps and approximate timeframes?

Take notes during the conversation, including the date, time, and the representative’s name. Organized records help keep your auto body repair insurance claim on track.

Step 3: Understand Your Coverage and Deductible

Once your claim is opened, review your policy documents or your insurer’s online portal. A clear understanding of your coverage ensures you’re not surprised by out-of-pocket costs.

Key Terms That Affect Your Repair Bill

Deductible – The amount you pay before your insurance contributes. For example, if repairs cost $4,000 and your deductible is $500, the insurer typically pays $3,500.

Policy limits – Maximum amounts your insurer will pay. Severe damage can push claim totals closer to these limits.

Actual cash value (ACV) – What your car is worth today, not what you paid for it. If repair costs approach or exceed the ACV, the vehicle may be declared a total loss.

OEM vs. aftermarket parts – Some policies specify whether original equipment manufacturer parts are covered or if aftermarket/remanufactured parts may be used.

These details shape how your auto body repair insurance claim is resolved and whether your car is repaired or totaled.

Step 4: Choose the Right Auto Body Shop

Your choice of repair facility can significantly impact the quality, safety, and resale value of your vehicle. Many insurers offer “preferred” or “direct repair program” (DRP) shops, but in most states you have a legal right to choose any licensed repairer you trust.

Factors to Consider When Selecting a Shop

Certifications – Look for I-CAR Gold Class, ASE, or manufacturer certifications (such as Honda ProFirst, Ford, Tesla, etc.). These suggest technicians are trained in current repair methods.

Experience with your vehicle type – Modern vehicles have advanced safety systems, sensors, and materials. A shop familiar with your brand and model is better equipped to restore it correctly.

Warranty on repairs – Reputable shops typically provide written warranties on paint and workmanship.

Customer reviews – Look beyond star ratings and read actual comments about communication, timelines, and satisfaction with the final result.

Insurers may try to steer you to preferred vendors, but independent experts emphasize that your repair facility should be your choice. You can still have a seamless auto body repair insurance claim process while using a shop that prioritizes manufacturer-approved repair procedures.

Step 5: Get a Thorough Repair Estimate

A detailed repair estimate serves as the roadmap for your claim. Some insurers will send an in-house adjuster, while others rely on photos or virtual tools. Most quality body shops can also write estimates that insurers accept.

What a Solid Estimate Should Include

Line-by-line breakdown of parts and labor.

Identification of structural vs. cosmetic damage.

Notes on necessary diagnostic scans and calibrations for ADAS (advanced driver assistance systems).

Paint, materials, and any sublet work (glass repair, frame straightening, etc.).

For complex damage, a “tear-down” may be needed. This involves partially disassembling damaged areas to reveal hidden issues. It’s common for the initial estimate to change once the vehicle is opened up—something industry data reflects in the growing prevalence of supplements in collision claims.

Step 6: Work With the Insurance Adjuster

The adjuster is the insurer’s representative responsible for evaluating damage and approving repair costs. How you interact with the adjuster can influence how efficiently your auto body repair insurance claim moves forward.

Tips for Productive Communication

Be responsive to calls and emails to avoid delays.

Ask if the adjuster will inspect the vehicle at your chosen repair shop; this often helps align expectations.

Request written explanations if certain repairs or parts are denied.

Let your body shop communicate directly with the adjuster about technical details and supplements; they speak the same language.

Remember that the adjuster’s role is to protect the insurer’s financial interests while honoring policy obligations. You have the right to question line items and to advocate for safe, complete repairs—especially when your repairer cites manufacturer repair guidelines.

Step 7: Approve the Repair Plan and Parts

Once the estimate is agreed upon, your repair shop will finalize a repair plan. This is your opportunity to understand exactly what will be done to your vehicle.

OEM vs. Aftermarket Parts

Whether your auto body repair insurance claim covers OEM parts depends on your policy and local regulations. Key considerations include:

Safety and fit – OEM parts are engineered to match your vehicle’s crash performance and design specifications.

Warranty implications – Some manufacturers caution that non-OEM parts can affect coverage on certain components.

Resale value – Future buyers or dealers may value OEM repairs more highly.

If your policy defaults to aftermarket or remanufactured components, ask your shop and insurer whether OEM parts are available and what the cost difference would be. In some cases, you may choose to pay the difference out of pocket.

Scope of Work

Ask your shop to walk you through the plan:

What panels will be repaired vs. replaced?

Will structural components be measured and aligned using frame machines and computerized systems?

Which systems (sensors, cameras, radar) require post-repair calibration?

How long is the expected repair timeline, including potential delays for parts?

A clear repair plan aligns expectations among you, the shop, and the insurer, and it reduces surprises as your auto body repair insurance claim progresses.

Step 8: Manage Transportation and Rental Coverage

While your car is in the shop, you’ll likely need alternative transportation. Many policies include rental coverage, but terms vary widely.

Know Your Rental Car Benefits

Daily rental limits (for example, $30 per day) and maximum total days.

Whether coverage is limited to certain vehicle classes.

When rental coverage starts—immediately after the accident or once repairs begin.

If you’re filing a third-party auto body repair insurance claim against another driver’s policy, their insurer may be responsible for rental costs. However, you might have to pay up front and be reimbursed, depending on the carrier’s process.

Step 9: Monitor the Repair Progress

Quality repair facilities maintain regular communication as work progresses. Still, it’s wise to stay engaged and informed.

Questions to Ask During Repairs

Have any hidden damages been discovered?

Has the shop submitted supplements to the insurer, and are they approved?

Has the target completion date changed?

Are all necessary scans and calibrations scheduled?

Thanks to increasingly sophisticated vehicle technology, more repairers are performing pre- and post-repair electronic scans. Industry studies show that failing to properly calibrate ADAS components can compromise lane-keeping, automatic braking, and collision warning systems. Making sure these are included in your auto body repair insurance claim is a matter of safety, not just cost.

Step 10: Inspect the Vehicle Before Final Payment

When the shop notifies you that repairs are complete, take time for a careful inspection before signing off.

Checklist for Final Inspection

Look at panels in natural light: do color and finish match adjacent areas?

Check gaps between doors, hood, trunk, and fenders for uniform spacing.

Open and close all doors, trunk, and hood to ensure smooth operation.

Confirm that warning lights are off and dashboard messages are normal.

Test features like lane-keeping assist, parking sensors, backup camera, and adaptive cruise, if equipped.

Take a short test drive to listen for unusual noises or vibrations.

Ask the shop to review the final invoice with you line by line. It should align with what was approved in your auto body repair insurance claim, including any supplements. Ensure you receive written copies of:

The itemized invoice.

Any parts and labor warranties.

Documentation of alignments, scans, and calibrations.

If anything doesn’t seem right, address it before you leave. Reputable shops want you satisfied and are usually willing to correct concerns promptly.

Common Mistakes to Avoid With Auto Body Repair Insurance Claims

Even seasoned drivers can stumble during the claims process. Awareness of common pitfalls helps you avoid unnecessary expense or frustration.

Rushing to Accept the First Offer

Some policyholders feel pressured to accept the insurer’s first assessment or cash-out offer. If the estimate seems low or doesn’t reflect the damage you see, consult your body shop or consider an independent appraisal before agreeing. Once you’ve accepted a settlement, reopening an auto body repair insurance claim can be difficult.

Ignoring Diminished Value

Even after expert repairs, vehicles with accident histories often lose resale value. In some states, you may be entitled to a “diminished value” claim, especially when another driver was at fault. Documenting pre-accident condition and mileage can support such a claim.

Not Reading the Fine Print

Policy details on storage fees, total loss thresholds, and aftermarket parts can significantly affect your bottom line. Reviewing these terms before and during your claim can prevent surprises like unexpected out-of-pocket charges or disputes over how the vehicle should be repaired.

When to Consider Professional Help

Most straightforward auto body repair insurance claims can be handled without legal representation. However, there are situations where an attorney, public adjuster, or consumer advocate may be beneficial:

Liability is strongly disputed, and fault affects your rates or ability to recover damages.

The insurer is significantly underestimating repair costs compared to multiple expert estimates.

Injuries are involved, and medical bills or lost wages are substantial.

Your vehicle is declared a total loss, and you disagree with the valuation.

Consultations with consumer attorneys are often free, and even a brief discussion can clarify your options if your auto body repair insurance claim becomes contentious.

Future-Proofing: Preparing Before You Ever Need a Claim

One of the best ways to handle a claim smoothly is to prepare before you ever need one. A few proactive steps can pay off significantly after an accident.

Review and Adjust Your Coverage Annually

Confirm that collision and comprehensive limits match your vehicle’s current value and your risk tolerance.

Evaluate your deductible: higher deductibles lower premiums but increase your out-of-pocket cost per claim.

Ask about OEM parts riders, rental reimbursement, and roadside assistance if you value those protections.

Keep Vehicle Records Organized

Maintain a file (digital or physical) that includes:

Purchase documents and financing or leasing agreements.

Maintenance records and significant upgrades.

Photos of your vehicle in good condition (interior and exterior).

These records can support your position in a future auto body repair insurance claim, especially if your vehicle’s pre-accident condition is questioned.

Conclusion: Taking Control of the Claims Process

An accident can disrupt your routine, but it doesn’t have to derail your finances or peace of mind. When you understand each stage of an auto body repair insurance claim—from documenting the scene, to working with adjusters, to verifying that repairs meet modern safety standards—you put yourself in the best position to protect your investment.

Be proactive, ask questions, and lean on reputable professionals. Your insurer plays a central role, but you remain the decision-maker. With the right information and approach, you can turn a stressful collision into a controlled, manageable process that restores both your vehicle and your confidence on the road.