Filed under Auto Insurance on

Auto Insurance Vehicle Class Codes Explained

Understanding how your insurer classifies your vehicle can be the difference between an accurate premium and overpaying for coverage you don’t need. Yet, for most drivers, “class codes” and rating symbols sound like something buried deep in an underwriter’s manual—not something that affects everyday life. In reality, they play a central role in how your insurance costs are calculated.

This guide breaks down auto insurance vehicle class codes in straightforward language. You’ll learn what they are, why they matter, and how to make sure your vehicle is classified correctly so you’re paying a fair price for your policy.

What Are Auto Insurance Vehicle Class Codes?

Auto insurance vehicle class codes are numerical or alphanumeric labels insurers use to categorize vehicles based on risk-related characteristics. These codes help companies translate complex information—like body style, performance, safety features, and use—into a standardized rating system for premiums.

Instead of looking at thousands of vehicle models one by one, insurers assign each vehicle to a class code that reflects its expected claim frequency and severity. The code becomes a building block within your overall rating formula, alongside factors like driver history, location, and coverage limits.

Why Insurers Use Class Codes

From an insurer’s perspective, class codes are about consistency and predictability. By grouping similar vehicles together, they can:

- Estimate average repair and replacement costs more accurately

- Project how often certain vehicle types are likely to be involved in accidents

- Account for theft risk and safety technology across vehicle categories

- Maintain transparent and repeatable pricing models for regulators and customers

When you see the term auto insurance vehicle class codes on your declarations page or in underwriting manuals, you’re looking at the backbone of how your car is treated in the rating system.

How Vehicle Class Codes Affect Your Premium

Two drivers with clean records, living on the same street, can pay very different premiums simply because of their car’s classification. Here’s how auto insurance vehicle class codes directly influence what you pay.

1. Expected Claim Costs

Insurers maintain years of data on how much it costs to fix or replace different categories of vehicles. For example:

- Luxury sedans and high-end SUVs often have more expensive parts and advanced electronics, leading to higher repair bills.

- Compact economy cars may be cheaper to repair but could fare worse in serious crashes, changing the pattern of medical or injury-related claims.

- Performance sports cars frequently show higher claim frequency due to aggressive driving patterns and speed-related accidents.

Auto insurance vehicle class codes capture these realities in a standardized way. A class associated with higher average claim severity will produce higher base rates for that group of vehicles.

2. Vehicle Safety and Crashworthiness

Safety technology has changed how insurers view risk. Vehicles with strong crash-test ratings, multiple airbags, automatic emergency braking, and advanced driver-assistance systems tend to generate fewer severe injury claims. Over time, this can lead to more favorable class codes or rating symbols.

Conversely, older models without modern safety features may carry codes that reflect higher injury and liability risk. When you see discussions about auto insurance vehicle class codes aligning with IIHS or NHTSA safety data, this is the connection: safer vehicles often earn better classifications.

3. Theft and Vandalism Risk

Some vehicles are prime targets for theft or catalytic converter removal, while others rarely appear in theft statistics. Insurers monitor law enforcement and industry data to understand which vehicles attract criminal activity.

Class codes in higher theft-risk categories can raise comprehensive premiums, even if the vehicle is otherwise moderate in cost or performance. Anti-theft features, tracking systems, and immobilizers can sometimes mitigate this, contributing to more favorable class code assignments.

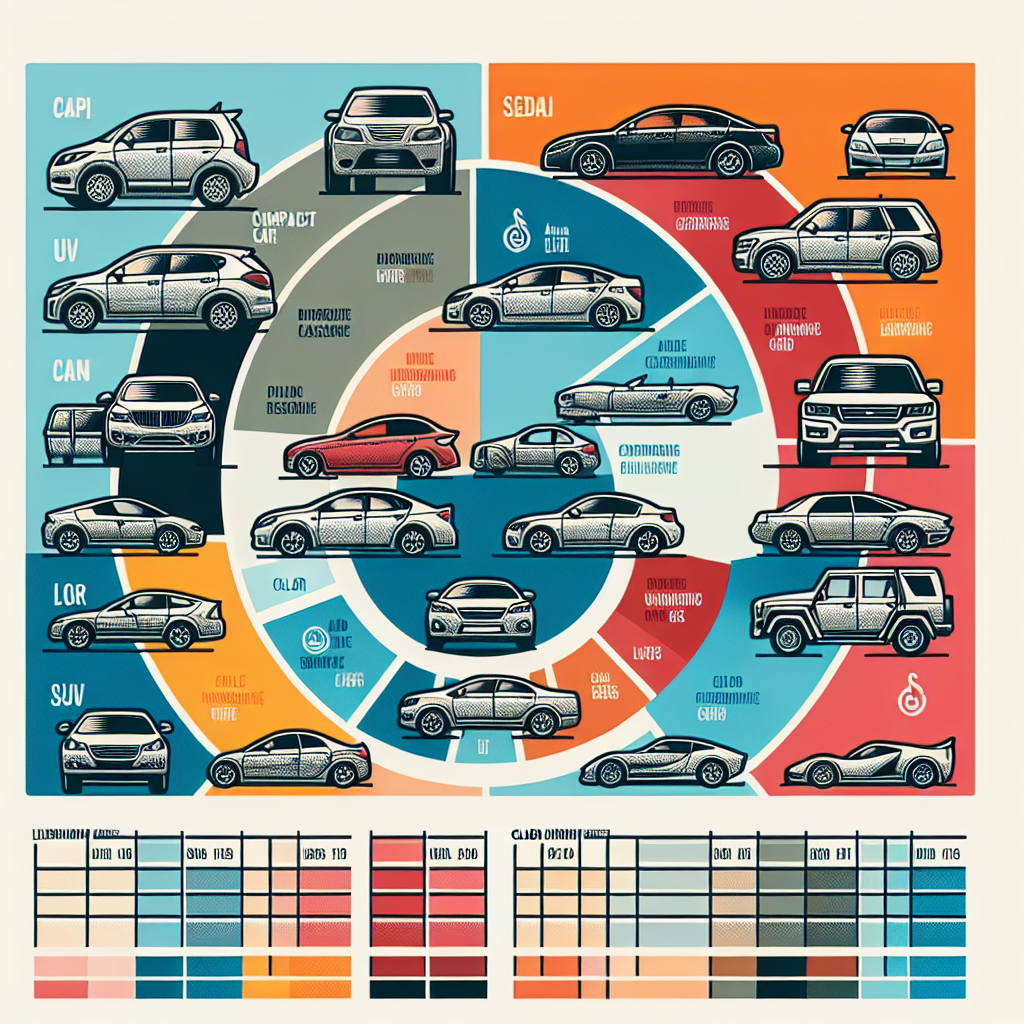

Common Types of Auto Insurance Vehicle Class Codes

Each insurer and rating organization uses its own classification structure, but many share common principles. You might not see the internal tables, yet understanding the main categories will give you insight into where your car likely fits.

Body Style and Vehicle Type

One of the basic ways auto insurance vehicle class codes are determined is by body style and general vehicle type. Typical groupings include:

- Compact and subcompact cars – Smaller, lighter vehicles; often associated with lower purchase prices but mixed outcomes in crash data.

- Midsize and full-size sedans – Bread-and-butter passenger cars used for daily commuting and family transportation.

- Crossovers and SUVs – Now among the most popular categories, with a wide range of sizes, prices, and safety profiles.

- Pickup trucks – Utilitarian vehicles with growing use as family transport; payload and towing expectations can affect risk.

- Minivans – Family-focused vehicles often associated with conservative driving patterns and strong safety records.

- Sports and performance cars – Designed for speed and handling; often classified in higher-risk classes.

A two-door performance coupe won’t share the same class as a three-row minivan, even if they’re the same model year and price. Their driving behavior profiles and claim histories are simply too different.

Usage-Based Class Codes

How you use your vehicle can be as important as what you drive. Many insurers layer usage codes into the overall classification:

- Pleasure use – Limited commuting, mostly personal errands and weekend driving.

- Commute use – Daily trips to and from work or school, often with specific mileage ranges.

- Business use – Regular use for work-related travel, client visits, or sales calls.

- Commercial use – Vehicles primarily used for deliveries, service calls, or transporting equipment.

While not always referred to as auto insurance vehicle class codes in consumer materials, these usage designations interact with your vehicle class to produce a final rate tier. The same car classified for pleasure use may be more expensive when coded for heavy commuting or commercial activity.

Territorial Classifications

Some insurers integrate geographic risk directly into their coding. For instance, a vehicle in a dense urban area with high accident and theft rates may be placed in a different rating class than the same car in a suburban or rural area.

While territory often appears as a separate rating factor, some carriers embed it within their broader auto insurance vehicle class codes, especially in proprietary systems designed to streamline internal rating.

How Class Codes Are Created and Updated

Vehicle classification isn’t static. Insurers constantly refine auto insurance vehicle class codes based on new data, evolving technology, and regulatory oversight. Understanding how codes are created can help you see why rates change over time.

Actuarial Analysis and Loss Data

Actuaries review historical claim data to identify patterns. They look at:

- Frequency of claims by vehicle type and model year

- Average cost of repairs and parts

- Severity of injuries associated with different vehicle groups

- Trends in total loss rates and salvage values

When claims for a particular class rise consistently—for example, due to higher parts prices or more severe crashes—insurers may adjust the class code rating or create new categories for better precision.

Influence of Industry Organizations

In many markets, industry bodies assist in developing standardized rating structures. For example, advisory organizations may publish symbol systems that account for factors like:

- Vehicle cost and MSRP

- Repair complexity and time

- Safety ratings and crash-test results

- Theft and vandalism statistics

Insurers can adopt these frameworks or blend them with their own proprietary auto insurance vehicle class codes to fine-tune risk assessment.

Regulatory Oversight

State or national regulators typically review rating plans to ensure fairness and prevent discriminatory practices. When insurers file changes to their class code structures, regulators may require justification backed by credible loss experience and actuarial analysis.

This oversight helps ensure that auto insurance vehicle class codes are rooted in objective risk factors rather than arbitrary distinctions.

Real-World Examples of Class Code Impact

To see the effect of classification, consider three simplified scenarios. Actual rating plans are more complex, but these examples illustrate the concept.

Example 1: Economy Car vs. Luxury Sedan

- Driver A chooses a basic compact car with strong safety ratings.

- Driver B selects a high-end luxury sedan with advanced electronics and imported parts.

Even if both drivers have identical records, live in the same ZIP code, and choose the same coverages, their auto insurance vehicle class codes will differ. Driver B’s car may carry a code associated with higher collision and comprehensive costs due to expensive bodywork, custom components, and complex sensors. Result: a noticeably higher premium.

Example 2: Family Minivan vs. Sports Coupe

- Driver C owns a minivan primarily used for school runs and weekend trips.

- Driver D owns a two-door sports coupe known for powerful acceleration.

Actuarial data often show that minivans are driven more conservatively, with fewer high-speed losses and lower injury claim severity. Sports coupes, by contrast, may be overrepresented in speed-related crashes. Their respective auto insurance vehicle class codeswill reflect these behavioral patterns, typically giving the minivan a more favorable rating class.

Example 3: Same Vehicle, Different Use

- Driver E uses a small SUV only for weekend trips and errands.

- Driver F uses the same model SUV daily for long-distance commuting and client visits.

The base vehicle class code may be identical, but additional usage codes for business or heavy commuting can push Driver F’s rate higher. Insurers recognize that more time on the road generally means more exposure to potential loss.

Trends Shaping Modern Vehicle Class Coding

The concept of auto insurance vehicle class codes has evolved dramatically in the past decade. Insurers now draw on richer datasets and advanced analytics, reshaping how vehicles are grouped and priced.

Advanced Safety and Driver-Assistance Features

Features such as lane-keeping assistance, adaptive cruise control, blind-spot monitoring, and automatic braking have reduced certain types of collisions. However, they also increase the cost and complexity of repairs.

Recent industry research shows a mixed impact on premiums: while frequency of crashes may decline, the severity and cost of each repair can rise. As a result, auto insurance vehicle class codes increasingly balance the benefits of fewer accidents against the reality of expensive sensors and cameras.

Electric and Hybrid Vehicles

Electric and hybrid vehicles present a new classification challenge:

- Battery packs and specialized components are costly to repair or replace.

- Some models boast excellent safety performance and strong structural protection.

- Repair networks and technician specialization can influence labor costs.

Insurers have begun developing refined class codes specific to EVs and hybrids, rather than treating them as simple variants of conventional models. As the EV market matures, expect more granular segmentation and, in some cases, more competitive pricing for models with strong safety and loss records.

Telematics and Usage-Based Insurance

Telematics programs, which track driving behavior via plug-in devices or smartphone apps, are changing the weight placed on traditional class coding. While your vehicle classification still matters, insurers can overlay real-time data on:

- Braking and acceleration patterns

- Time of day you drive

- Average trip length

- Phone use or distraction indicators

For careful drivers, this can offset some of the disadvantage of being in a higher-risk auto insurance vehicle class code. For example, a cautious driver in a sporty vehicle may earn discounts that narrow the gap with more conservatively classified models.

How to Check and Understand Your Vehicle Class Code

Most policyholders never look at the underlying codes on their policies, but you can—and you should if you suspect your premium doesn’t match your vehicle’s true profile.

Where to Find Class Information

Start with your declarations page and policy documents. While insurers may not display the term “class code” explicitly, you can look for:

- Vehicle descriptions and symbols next to each car on the policy

- Use type (pleasure, commute, business, or commercial)

- Notations about program tiers, such as preferred, standard, or non-standard

If you want more detail, ask your agent or carrier representative directly for the specific auto insurance vehicle class codes assigned to your car and how they influence the rating.

Questions to Ask Your Insurer

When you speak with your insurer, consider asking:

- Which class or symbol applies to my vehicle, and why?

- Is my car rated for the correct primary use (pleasure, commute, etc.)?

- Are annual mileage estimates accurate and reflected in the classification?

- Have any safety or anti-theft features been fully credited?

These questions not only help you understand your auto insurance vehicle class codes, but may also reveal rating assumptions that can be corrected in your favor.

Common Mistakes and Misclassifications

Even reputable insurers can occasionally misclassify a vehicle, especially if information is incomplete or outdated at the time of quoting. Spotting errors can save you money and prevent coverage disputes down the line.

Incorrect Vehicle Trim or Model

If the wrong trim level is recorded—for instance, listing a base model instead of a performance variant, or vice versa—the corresponding class code and rating symbol might not match your actual vehicle. This can distort both cost and coverage details.

Always verify that your VIN, model year, and trim information are correct on the policy. A mismatched description can lead to a misaligned auto insurance vehicle class code and an inaccurate premium.

Wrong Usage Classification

A vehicle occasionally used for work errands might be mistakenly coded as full business use, significantly raising rates. Conversely, a car heavily used for commuting but rated as pleasure use could become a point of contention if a claim reveals the discrepancy.

Ensure your disclosed usage is accurate and consistent with your real-world driving pattern. If it changes—such as starting a longer commute or using the car for a side business—update your insurer promptly.

Outdated Data After Major Changes

Class codes may also need updating when:

- Significant safety enhancements are added, such as aftermarket collision-avoidance systems

- The vehicle is modified in ways that affect performance or value

- Ownership changes result in different primary drivers or garaging locations

Letting your insurer know about these changes helps keep your auto insurance vehicle class codes current and aligned with your actual risk profile.

How to Use Class Codes to Your Advantage

While you can’t rewrite the actuarial tables, you can make smarter choices by understanding how classification works. A few strategic decisions can improve your rating picture.

Research Before You Buy

When you’re shopping for a new or used car, ask your insurer for quotes on multiple models you’re considering. Pay attention to how premiums shift:

- Compare a compact SUV vs. a midsize sedan with similar price tags.

- Look at insurance differences between trim levels (base vs. performance packages).

- Evaluate how safety packages and driver-assistance suites influence rates.

These comparisons reveal how auto insurance vehicle class codes treat each option. A seemingly small change in trim or body style can translate into hundreds of dollars per year in premium differences.

Align Use and Coverage with Reality

If you’ve moved closer to work, retired, or significantly reduced your mileage, let your insurer know. Lower use can move your rating into a more favorable classification or at least reduce exposure-based charges.

Similarly, if a vehicle transitions from daily driving to occasional use—for example, becoming a secondary or hobby car—ask your agent how that affects the coding. Adjusting usage can sometimes lower the effective impact of less favorable auto insurance vehicle class codes.

Leverage Safety and Anti-Theft Features

When adding safety or security upgrades, document them and share the details with your carrier. While not every feature will shift your core class code, many companies apply supplemental credits that partially offset risk-based surcharges.

In areas with high theft rates, investing in immobilizers, vehicle tracking, secure parking, or high-visibility deterrents can help your comprehensive premium and reduce the effect of theft-prone classifications.

Key Takeaways

Auto insurance vehicle class codes may seem like inside baseball for actuaries and underwriters, but they have a direct impact on your premium. By understanding how your vehicle is categorized, you can make more informed decisions about what you drive, how you use it, and how you shop for coverage.

- Class codes group vehicles with similar risk profiles so insurers can price policies consistently.

- Factors such as body style, performance, safety technology, theft risk, and vehicle use all shape your classification.

- Trends like advanced driver-assistance systems, electric vehicles, and telematics are reshaping how auto insurance vehicle class codes are built.

- Checking your policy for accuracy—and asking questions about how your car is coded—can uncover opportunities to correct errors and reduce costs.

- Comparing insurance quotes before purchasing a vehicle helps you see how different models and trims are treated in the rating system.

Ultimately, you don’t need to memorize every code or symbol. But knowing the logic behind auto insurance vehicle class codes transforms them from mysterious numbers on a page into useful tools you can navigate, question, and use to your financial advantage.