Filed under Auto Insurance on

State Farm Auto Insurance Road Service Guide

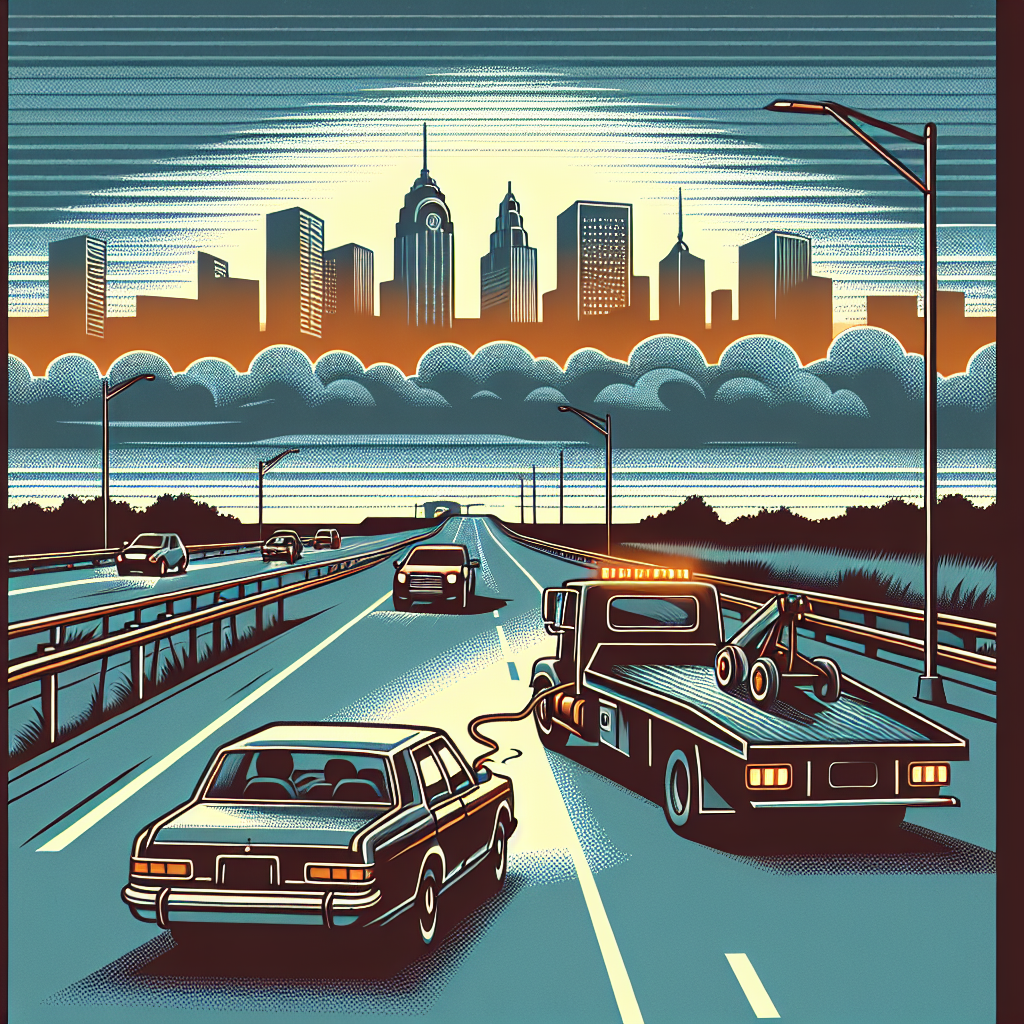

Getting stranded on the side of the road is stressful, no matter how experienced you are behind the wheel. Whether it is a flat tire in rush hour traffic or a dead battery in a quiet parking lot at night, knowing help is just a phone call away can make all the difference. That is where understanding your State Farm auto insurance road service options becomes essential.

Many drivers assume roadside assistance is automatically included in their car insurance — but coverage details, eligibility, and service limits can vary. This guide breaks down how State Farm’s emergency road service works, what it covers, what it costs, and how to decide if it is right for you.

What Is State Farm Auto Insurance Road Service?

State Farm auto insurance road service is an optional add-on coverage that helps pay for common roadside emergencies. Instead of paying a tow truck or locksmith out of pocket, you can use this coverage to offset or fully cover those costs, depending on the situation.

In simple terms, it turns a potentially expensive and stressful breakdown into a manageable inconvenience. You continue to use your regular State Farm auto insurance policy for accidents and liability, while road service handles non-collision mishaps such as lockouts or fuel delivery.

Why Roadside Assistance Matters

According to industry data from AAA and other providers, roadside calls number in the tens of millions each year, with the most common issues including dead batteries, tire problems, and lockouts. Even newer vehicles are not immune — modern electronics, long commutes, and inconsistent maintenance can all lead to breakdowns.

State Farm auto insurance road service is designed to address exactly these kinds of everyday problems. For many drivers, the peace of mind alone justifies the relatively modest cost of adding this coverage to their policy.

What Does State Farm Roadside Assistance Typically Cover?

While policy details can vary by state and individual policy, State Farm’s emergency road service generally focuses on five core areas. Understanding these can help you decide when to use your coverage versus handling a situation yourself.

1. Towing Services

Towing is often the most valuable component of State Farm auto insurance road service. If your vehicle is disabled due to a mechanical issue or other covered event, State Farm will help arrange and pay for a tow to a repair facility or another destination, within policy limits.

- Coverage often applies whether your car is at home, at work, or on the road.

- Some policies may limit towing distance or maximum payout per incident.

- You typically choose the repair shop, though local restrictions may apply.

Research from towing associations shows that short-distance tows can easily exceed $100, and longer-distance hauls can cost several hundred dollars. Having this covered even once can offset years of premiums for road service.

2. Lockout Assistance

Locking your keys in the car happens more often than most drivers like to admit. With State Farm auto insurance road service, a professional locksmith can be dispatched to help unlock your vehicle.

- Covers unlocking the vehicle when keys are locked inside.

- In some cases, may include limited reimbursement for key replacement or reprogramming, depending on policy and state.

- Advanced key fobs and smart locks can cost hundreds, so understanding your limits is important.

With today’s keyless entry systems, replacing or reprogramming keys can become expensive fast. Even if only the lockout service is covered, avoiding a high emergency call-out fee is a key advantage of having this protection.

3. Battery Jump-Start and Minor Mechanical Aid

Few things are more frustrating than finding your car battery dead when you are running late. State Farm auto insurance road service typically includes a jump-start if your battery fails.

- A service provider comes to your location to attempt a jump-start.

- In some cases, may include basic mechanical assistance (for minor issues only).

- If the car cannot be started, towing benefits can apply.

Industry reports suggest that battery-related issues are among the top reasons for roadside calls, especially in regions with extreme temperatures. This makes jump-start coverage particularly valuable in cold or very hot climates.

4. Flat Tire Change

Hitting a nail or pothole can leave you with a flat tire at the worst possible time. State Farm auto insurance road service generally covers flat tire changes when you have a usable spare.

- Service provider will install your spare tire at the roadside.

- If you do not have a spare or the tire is not usable, towing may be arranged.

- Coverage does not usually include the cost of new tires or repairs at the shop.

Even if you know how to change a tire yourself, having professional help can be safer on busy highways or in bad weather, and can be especially helpful for older drivers or those with mobility limitations.

5. Fuel Delivery

Running out of gas is inconvenient and sometimes embarrassing, but it happens. With State Farm auto insurance road service, fuel can be delivered to your location to help you reach the nearest station.

- Includes delivery of gasoline or diesel fuel (availability may vary by area).

- Some policies cover the fuel cost; others may charge you for the fuel while covering the delivery.

- Designed to provide enough fuel to reach a nearby station, not to fill the entire tank.

Fuel delivery is particularly useful in rural areas, on long road trips, or for new drivers who are still learning to plan refueling stops effectively.

How Much Does State Farm Roadside Assistance Cost?

One of the reasons many drivers choose to add State Farm auto insurance road service is the cost-effectiveness. As of recent industry estimates, insurer-provided roadside assistance typically ranges from a few dollars per year up to a relatively small annual fee per vehicle.

While exact pricing depends on your location, policy type, and driving profile, State Farm’s road service add-on is generally positioned to be competitive with or cheaper than many standalone roadside memberships.

- Cost is often lower than traditional motor club memberships.

- Coverage can be added per vehicle, so you only pay for cars that need it.

- Bundling with other State Farm coverages may provide additional value.

Because pricing can change and may differ by state, the most reliable way to get an accurate figure is to contact your State Farm agent or check your online account. It is wise to compare the premium against what you might pay out of pocket for a single tow or lockout to evaluate the value.

Who Is Eligible for State Farm Auto Insurance Road Service?

State Farm auto insurance road service is generally available as an optional coverage on personal auto policies, subject to state regulations and underwriting approval. To determine eligibility, consider the following points:

- The vehicle must be listed on an active State Farm auto insurance policy.

- Some vehicle types (such as commercial trucks or specialty vehicles) may have limited or different coverage options.

- Availability can vary by state and may be updated over time.

Drivers who frequently commute, travel long distances, or have older vehicles often find this coverage especially appealing. Households with teen drivers may also value the security of knowing help is available if inexperienced drivers face a breakdown.

How to Request Roadside Help Through State Farm

When you have an urgent roadside issue, you do not want to waste time figuring out whom to call. State Farm offers multiple ways to access your road service benefits, making it easier to get help quickly.

Using the State Farm Mobile App

For many policyholders, the mobile app is the fastest way to request assistance. You can usually:

- Log into your account and access the roadside assistance section.

- Share your exact location using your phone’s GPS.

- Provide details about the issue (flat tire, dead battery, lockout, etc.).

- Track the status of your service provider’s arrival, when available.

App-based requests can reduce miscommunication about your location and create a clear digital trail of the service request.

Calling Roadside Assistance by Phone

If you prefer to call or do not have your phone’s data enabled, you can contact State Farm’s roadside assistance phone line. The number is often printed on your insurance ID card or available through your agent’s office.

- Be prepared to provide your policy number and vehicle details.

- Describe the problem and your approximate location.

- Follow the dispatcher’s instructions and stay safe while waiting.

Phone requests remain an important option in areas with poor data coverage or for drivers who are more comfortable speaking with a representative.

Submitting Claims or Reimbursement Requests

In some situations, you may choose to call a service provider directly and then seek reimbursement from State Farm auto insurance road service, if your policy allows for it. When doing so:

- Keep all receipts and documentation from the service provider.

- Contact State Farm promptly to report the incident.

- Confirm reimbursement limits and eligible services with your agent or claims representative.

Reimbursement options and procedures can vary, so it is wise to review your policy details ahead of time instead of waiting until after a breakdown occurs.

State Farm Roadside Assistance vs. Other Options

Before committing to any coverage, it is helpful to compare State Farm auto insurance road service to other roadside solutions, such as dedicated membership clubs or vehicle manufacturer programs.

Roadside Clubs (e.g., AAA and Others)

Traditional roadside membership clubs often include benefits beyond basic towing and lockouts, such as travel discounts, trip planning, or extended coverage on any vehicle you are driving.

- Pros: Broader benefits, potential discounts with partner businesses.

- Cons: Typically higher annual costs than insurer add-ons; benefits may overlap with coverage you already have.

If you mainly want reliable roadside help without extra travel perks, the lower cost and integration with your existing policy may make State Farm’s option more appealing.

Automaker and Warranty Programs

Many new vehicles include complimentary roadside assistance for a limited period (often tied to the basic warranty). These services can be robust but usually expire after several years or a specific mileage limit.

- Pros: Often free during the warranty period; tailored to your vehicle.

- Cons: Time-limited; may not cover older vehicles in your household.

If your car’s factory roadside coverage is ending or you own multiple vehicles of different ages, adding State Farm auto insurance road service can help maintain consistent protection.

Credit Card and Travel Benefits

Certain premium credit cards offer roadside assistance as a cardholder benefit. However, coverage limits and service types can be narrower than a dedicated policy add-on.

- Pros: Included with card membership; may cover multiple vehicles.

- Cons: Often lower coverage limits; may charge per use; may not include full towing benefits.

Comparing these options side by side with State Farm’s program can help you avoid paying twice for the same protections or relying on limited benefits that may fall short in a serious breakdown.

Key Limitations and Exclusions to Know

As with any insurance-related product, State Farm auto insurance road service comes with conditions and exclusions. Understanding them ahead of time prevents surprises when you need help most.

- Coverage generally applies to covered vehicles, not necessarily to any car you are driving.

- There may be limits on the number of service calls per policy term.

- Off-road recoveries, winching in hazardous environments, or services in restricted areas may be limited or excluded.

- Costs associated with repairs at a shop, new tires, new batteries, or replacement parts are usually not covered.

- Extraordinary towing distances or specialty vehicle handling may exceed standard coverage limits.

Policy documents and your agent can clarify the specifics in your state. Reading the fine print might not be exciting, but it ensures you use your benefits strategically and effectively.

Best Practices for Using Road Service Wisely

To get the maximum value from State Farm auto insurance road service, consider these practical strategies:

Review your coverage annually

Confirm which vehicles are covered and whether service limits still match your driving habits, especially if you move, change jobs, or add drivers.

Combine with preventive maintenance

Road service is a safety net, not a substitute for regular maintenance. Keeping up with tire inspections, battery tests, and fluid levels reduces the odds you will need to use it at all.

Store contact information in your phone and vehicle

Keep the State Farm roadside number and your policy details accessible in your glove box and mobile phone, so you are ready during an emergency.

Know when to request a tow

If a problem appears serious or you are in an unsafe location, it is often better to request a tow rather than trying to diagnose the issue yourself on the roadside.

Educate all drivers in your household

Make sure teen drivers, spouses, or family members understand how to contact State Farm roadside assistance and what details they will need to provide.

Trends Shaping the Future of Roadside Assistance

The roadside assistance landscape is evolving quickly as technology and driving patterns change. As insurers and service providers adapt, State Farm auto insurance road service is likely to continue integrating new tools and options.

- Connected vehicles: Many new cars can automatically transmit diagnostic data and location, helping service providers identify problems before they arrive.

- Telematics and usage-based insurance: Programs that track driving behavior may someday integrate with roadside assistance, prioritizing service or offering customized support based on real-world driving habits.

- Electric vehicles (EVs): As EV adoption grows, roadside services are adjusting to handle depleted batteries, specialized towing procedures, and charging assistance.

- On-demand service models: App-based dispatching and real-time tracking are making response times faster and more predictable.

Staying informed about these shifts can help you evaluate whether your current coverage still aligns with how and what you drive.

Is State Farm Auto Insurance Road Service Right for You?

No two drivers have the same needs, which is why the decision to add roadside coverage should be based on your specific situation. Consider the following questions:

- How old are your vehicles, and how reliable have they been historically?

- Do you commute long distances, drive in extreme weather, or travel frequently by car?

- Are there multiple drivers in your household, including teens or new drivers?

- Do you already have roadside coverage through a manufacturer, motor club, or credit card?

- Would a single major tow or lockout bill strain your budget?

If you drive regularly and do not already have comprehensive roadside assistance elsewhere, adding State Farm auto insurance road service can be a cost-effective way to protect yourself from unpredictable but common breakdowns.

How to Add or Review Road Service on Your Policy

Adding roadside assistance is usually straightforward, and it can often be done mid-policy term. To get started:

- Log into your State Farm account to check whether emergency road service is already listed as part of your coverage.

- Contact your State Farm agent to review coverage options, limits, and pricing in your state.

- Compare your policy details with any other roadside benefits you may have to avoid duplication.

Once added, confirm the effective date so you know exactly when your State Farm auto insurance road service protection begins. It is also wise to print or save updated ID cards and coverage summaries for reference.

Final Thoughts

Roadside emergencies rarely happen at convenient times, but they are an almost inevitable part of vehicle ownership. By understanding how State Farm auto insurance road service works, what it covers, and how to access it, you position yourself to handle breakdowns calmly and efficiently.

From towing and lockouts to jump-starts and flat tires, this optional coverage provides a practical safety net that often pays for itself with just one or two uses. When combined with regular maintenance and safe driving habits, it becomes a key part of a comprehensive protection strategy for you, your passengers, and your vehicles.

If you are unsure whether your current policy includes roadside assistance or want to learn more about limits and costs, take a few minutes to review your documents or reach out to your State Farm agent. Being prepared now means fewer surprises when you need help most.