Filed under Business Insurance on

Understanding Business Liability Insurance in South Carolina

In today's fast-paced business environment, understanding the intricacies of business liability insurance is essential, particularly for companies operating in South Carolina. Business liability insurance offers critical protection against potential financial losses that could arise from legal claims. As such, it serves as an indispensable component of any risk management strategy in the Palmetto State. In this article, we will delve into the essentials of business liability insurance, the specific regulations and requirements in South Carolina, and why it is a must-have for any business aiming for long-term success.

What is Business Liability Insurance?

Business liability insurance is a type of coverage that protects a company against financial losses due to lawsuits or claims made by third parties. These claims could involve bodily injuries, property damage, or personal injury that allegedly occur because of the business's operations, products, or services. The primary objective of business liability insurance is to ensure that a company can continue operating despite facing potentially devastating legal claims.

Types of Business Liability Insurance

- General Liability Insurance: This is the most common form of liability insurance and provides broad protection against claims of bodily injury, property damage, and personal injury.

- Professional Liability Insurance (Errors & Omissions): Designed for businesses that provide specialized services or advice, this coverage protects against claims of negligence or inadequate work.

- Product Liability Insurance: Essential for manufacturers and retailers, it covers claims related to injuries or damages caused by defective products.

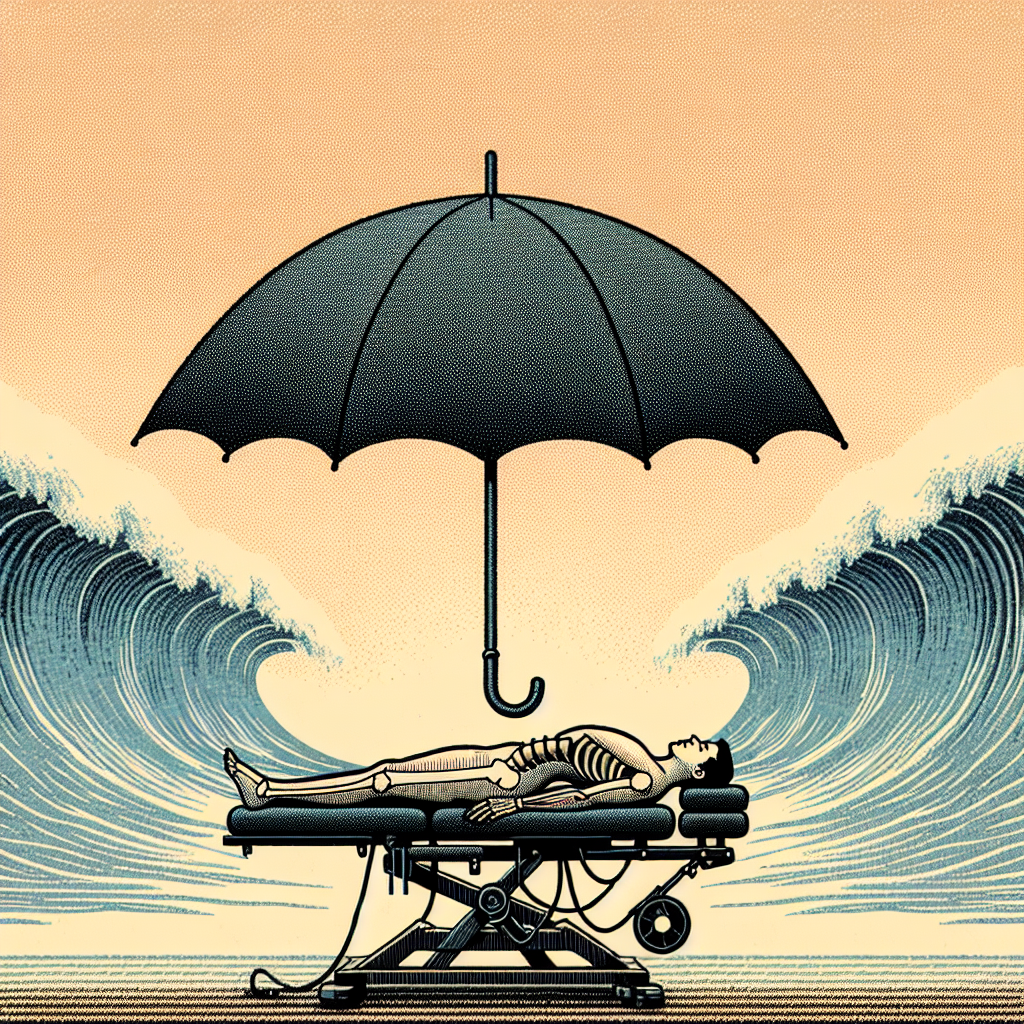

- Commercial Umbrella Insurance: This policy offers extended coverage, going beyond the limits of existing liability policies to provide extra financial protection.

Importance of Business Liability Insurance in South Carolina

South Carolina's unique business landscape, characterized by a diverse economy and flourishing industrial sectors, poses specific challenges that make business liability insurance particularly important. With industries ranging from tourism to manufacturing, businesses in South Carolina face a myriad of potential risks that could lead to costly legal disputes.

Compliance with State Regulations

In South Carolina, businesses are often legally required to carry specific liability insurance policies, especially if they contract with governmental entities or work in high-risk industries, such as construction. Failing to adhere to these requirements can result in severe penalties and leave a business vulnerable to significant financial losses.

Protecting Business Assets

Financial security is paramount for any business aiming to thrive. Business liability insurance protects not just the financial assets but also the reputation of the company. In the face of a lawsuit, having the right insurance can mean the difference between financial ruin and business continuity.

Key Considerations for South Carolina Businesses

Understanding the regional nuances and what factors to consider when selecting business liability insurance in South Carolina is crucial. Here, we explore several essential aspects that local businesses should scrutinize when crafting their insurance strategy.

Assessing Risk and Insurance Needs

Risk assessment is the first step towards effective risk management. Conducting a thorough evaluation of potential risks and liabilities helps businesses determine the necessary scope and type of insurance coverage. For example, a company in Charleston's thriving tourism sector may require different coverage compared to a manufacturing entity in the Upstate.

Customizing Insurance Policies

Every business is unique, and so are its insurance needs. Customizing business liability insurance to align with specific operational risks is vital. This might involve adjusting coverage limits or adding endorsements that address unique industry-specific risks.

Expert Opinions and Industry Trends

Keeping abreast of industry trends and expert opinions can provide valuable insights into the ever-evolving landscape of business liability insurance. In recent years, experts have noted a shift towards more comprehensive coverage plans that include cyber liability insurance, underscoring the growing threat of cyberattacks on businesses.

The Rise of Cyber Liability Insurance

With the digital transformation of business operations, cyber liability insurance has gained significance. South Carolina businesses need to be increasingly vigilant about data breaches and cyber threats, making this type of insurance a critical aspect of their liability coverage.

Expert Insights

Industry professionals emphasize the importance of working with experienced insurance brokers who understand the local market. By leveraging their expertise, businesses can secure tailored advice and create robust insurance plans that effectively mitigate risk.

How to Choose the Right Insurance Provider

Selecting the right provider for business liability insurance can make a significant difference in the quality of coverage and the overall insurance experience. Here, we outline some sub-steps to guide South Carolina businesses in making informed decisions.

Research and Compare

- Gather information about different insurance providers, focusing on those with a strong presence in South Carolina.

- Compare their offerings, coverage options, and pricing to identify the best fit for your business needs.

Check Credentials and Reputation

- Verify the credentials of prospective insurance providers, ensuring they are licensed and have a good standing.

- Look for customer reviews and testimonials to determine their reliability and customer service quality.

Negotiate Terms and Conditions

- Engage in discussions with insurance representatives to understand policy terms and negotiate conditions that are favorable for your business.

- Ensure clarity on all aspects of the policy, including premiums, deductibles, and coverage limits.

Conclusion

Understanding business liability insurance in South Carolina is not just about compliance but about safeguarding your company's future in a competitive and sometimes unpredictable market. By embracing a proactive approach and tailoring your coverage to meet specific needs, South Carolina businesses can mitigate risks effectively and focus on growth and innovation.

As the business landscape continues to evolve, staying informed about the latest trends and adapting insurance strategies accordingly will remain critical. With the right business liability insurance in place, companies can achieve peace of mind, knowing they are prepared for whatever challenges may come their way.