Filed under Home Insurance on

Types of Coverage for Home Insurance Explained

Whether you’re buying a first home or updating a long-held policy, understanding what your homeowners insurance actually covers is essential. Policies aren’t one-size-fits-all, and the details matter when a storm rips shingles, a pipe bursts, or a guest is injured on your property. In this guide, you’ll learn the core types of coverage for home insurance, the add-ons worth considering, and how to align limits with real-world risks and rebuilding costs. By the end, you’ll be able to compare quotes more confidently and avoid costly gaps.

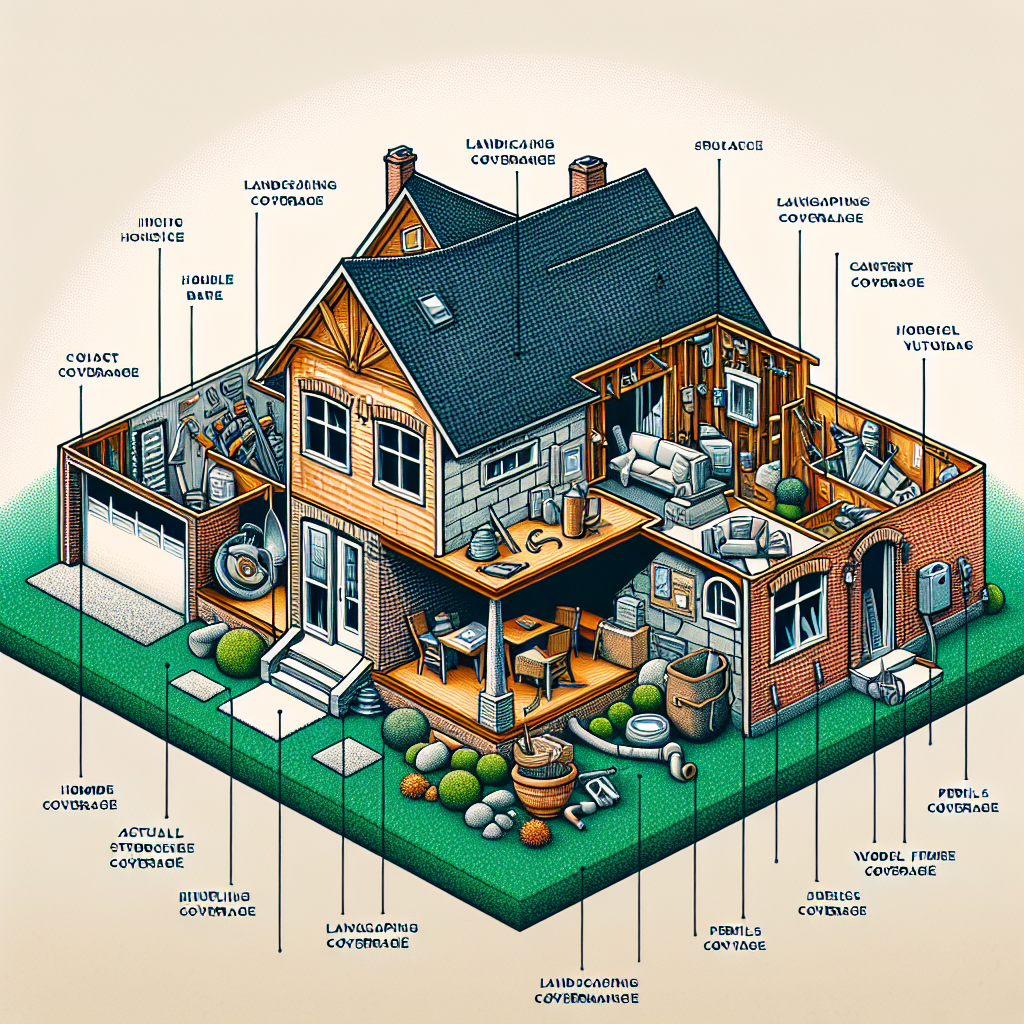

At a glance: what most policies include

Most homeowners policies (commonly HO-3, the most widely sold form in the U.S.) bundle several protections together. If you’re researching the types of coverage for home insurance, here’s the quick snapshot:

- Dwelling coverage for the structure of your home

- Other structures coverage for fences, detached garages, and sheds

- Personal property coverage for your belongings

- Loss of use (additional living expenses) if you can’t live at home after a covered loss

- Personal liability for injuries or property damage you cause to others

- Medical payments to others for minor injuries to guests, regardless of fault

From there, you can tailor your policy with endorsements to address water backup, service line failure, high-value items, and more. Because the types of coverage for home insurance vary by insurer and state, reading your policy forms and endorsements is as important as the quote itself.

Dwelling coverage: rebuild your home, not its market price

Dwelling coverage (Coverage A) pays to repair or rebuild your house if it’s damaged by a covered peril such as fire, wind, or hail. The key is insuring to the cost to rebuild—labor, materials, and code upgrades—not the real estate market value. Construction inflation has been volatile in recent years, and industry data shows rebuilding can be significantly higher than expected, especially after widespread events when materials and crews are scarce.

- Replacement cost: Pays to rebuild with new materials of similar kind and quality, up to your policy limit.

- Extended replacement cost: Adds a cushion (often 10%–50%) beyond your dwelling limit if costs spike after a catastrophe.

- Guaranteed replacement cost: Covers the full rebuild even if it exceeds the limit, offered by fewer carriers and in select states.

Common exclusions include flood, earth movement (like earthquakes or landslides), and routine wear and tear. These are typically addressed through separate policies or endorsements, which we cover later.

How to estimate an accurate rebuild cost

Insurers use replacement cost estimators based on square footage, roof style, custom features, and local labor rates. Still, provide details your estimator might miss:

- Specialty materials such as slate, copper, or hand-scraped hardwood

- Custom cabinetry, built-ins, or high-end appliances

- Unique architectural features or historical elements

- Finished basements, outdoor kitchens, or extensive decking

Ask about ordinance or law coverage for building code upgrades. If your home must be rebuilt to current code after a loss, this endorsement helps pay the extra cost—something many owners overlook until it’s too late.

Other structures: don’t forget what’s not attached

Other structures coverage (Coverage B) protects detached items like fences, sheds, pergolas, mailboxes, and detached garages. The limit is often 10% of your dwelling coverage by default. If you’ve invested in an elaborate workshop or a large detached garage, consider increasing this limit.

Personal property: what’s inside your home

Personal property coverage (Coverage C) protects your belongings—furniture, electronics, clothing, and more—at home and typically anywhere in the world. Two valuation methods matter here:

- Actual cash value (ACV): Pays replacement cost minus depreciation. Older items may yield much less than you expect.

- Replacement cost: Pays what it costs to buy a new item of like kind and quality. This endorsement is increasingly standard and worth having.

Policies also set special limits for categories prone to theft or large losses, such as jewelry, watches, furs, firearms, silverware, collectibles, and cash. If you own high-value items, consider scheduling them. A scheduled personal property endorsement lists specific items with appraisals and provides broader coverage with low or no deductible.

Make a painless home inventory

A home inventory is one of the most practical steps you can take. It speeds up claims and supports fair payouts.

- Walk-and-record: Take a video of each room, opening closets and drawers.

- Scan receipts and warranties to cloud storage; save serial numbers.

- Use inventory apps that export to spreadsheets for easy updates.

- Update when you make major purchases or renovations.

Loss of use: living expenses when you can’t stay home

Loss of use (Coverage D), also called additional living expenses (ALE), pays for temporary housing and extra costs if a covered loss makes your home uninhabitable. Examples include hotel or rental costs, extra commuting, pet boarding, and increased meal expenses. Keep all receipts and work closely with your adjuster to clarify reasonable costs and time frames. Limits can be a percentage of Coverage A or a time limit (e.g., 12–24 months), so confirm what applies to your policy.

Personal liability: protecting your assets

Personal liability (Coverage E) responds if you or a resident family member are legally responsible for bodily injury or property damage to others. It can cover legal defense, settlements, and judgments, even if the lawsuit is groundless. Typical scenarios include dog bites, a guest slipping on your walkway, or a child’s stray baseball breaking a neighbor’s window.

- Common limits: $300,000 or $500,000; many households choose at least $500,000.

- Umbrella policies: For additional protection in $1 million increments, a personal umbrella can extend liability coverage across home and auto.

- Exclusions: Business activities, intentional acts, and some dog breeds or trampolines may be restricted by insurer guidelines.

Medical payments to others: no-fault coverage

Medical payments to others (Coverage F) covers minor medical bills for guests injured on your property, regardless of fault. Think of it as goodwill coverage that can prevent small injuries from escalating. Limits are typically $1,000 to $5,000.

Named perils vs. open perils: what causes of loss are covered?

Coverage hinges on the cause of damage. HO-3 policies typically cover your dwelling on an open-perils basis—any cause of loss except those specifically excluded—while personal property is usually covered on a named-perils basis with a list such as fire, theft, vandalism, and certain water damage.

- Open perils: Broader protection; exclusions still apply (flood, earthquake, wear and tear, infestation, neglect, and more).

- Named perils: Coverage only for listed causes; review the list to avoid surprises.

- HO-5 policies: Often provide open-perils coverage for both dwelling and personal property, with higher sublimits—typically priced higher but worth quoting for well-appointed homes.

Popular endorsements and optional add-ons

Because the baseline policy can leave gaps, endorsements help you customize. When comparing the types of coverage for home insurance, these add-ons can make a material difference after a loss:

- Water backup and sump overflow: Covers damage from a backed-up drain, sewer, or sump. Standard policies usually exclude this.

- Service line coverage: Pays to repair underground utility lines you own, like water, sewer, and power lines from the street to your home.

- Equipment breakdown: Covers sudden failure of major systems—HVAC compressors, boilers, and smart home electronics—beyond normal wear and tear.

- Ordinance or law: Pays the extra cost to rebuild to current codes, often crucial for older homes and in areas with updated energy or safety requirements.

- Extended or guaranteed replacement cost: Provides a buffer if rebuilding costs surge after a catastrophe.

- Matching siding or roof: Helps replace undamaged materials to achieve a uniform appearance when partial damage occurs.

- Scheduled personal property: Broader coverage and higher limits for jewelry, art, instruments, or collectibles.

- Identity theft or cyber coverage: Assistance and limited reimbursement for covered cyber incidents and identity restoration.

- Green upgrade coverage: Pays to replace damaged systems with energy-efficient alternatives up to a specified amount.

- Home business or incidental occupancy: Extends coverage for business property and liability if you run a small business from home.

- Short-term rental or home-sharing endorsement: Required if you rent rooms or your entire home on short-stay platforms.

What standard policies don’t cover

Home insurance isn’t designed for every hazard. Major exclusions include:

- Flood: Requires a separate flood policy (through the National Flood Insurance Program or private insurers). Even properties outside high-risk zones can experience surface water flooding.

- Earthquake and earth movement: Typically excluded; coverage is available via endorsement or a separate policy in many states.

- Wear and tear, maintenance, rust, rot, mold, and infestation: Preventive maintenance is the homeowner’s responsibility.

- Sewer or drain backup: Usually excluded unless you add a water backup endorsement.

- Power failure off premises: May be excluded; check equipment breakdown or utility service endorsements for options.

- Intentional damage or business-related liability: Requires business-specific coverage.

Deductibles and limits: how payouts are calculated

Your deductible is the amount you pay out of pocket on a covered claim before insurance applies. Higher deductibles lower premiums, but make sure they’re realistic for emergencies. In coastal or storm-prone areas, you may see percentage deductibles for wind, hail, or hurricane losses (e.g., 1%–5% of the dwelling limit), which can be substantial on large homes.

- All-perils deductible: Applies to most covered claims except where special deductibles apply.

- Special deductibles: Percentage-based for wind/hail or hurricane; earthquake coverage also uses percentage deductibles.

- Sublimits: Categories like jewelry or cash have smaller caps; schedule high-value items to lift these limits.

Pricing factors and underwriting trends

Premiums reflect risk—your property’s location, features, and your personal history. While specifics vary by insurer and state regulation, common factors include:

- Location: Proximity to the coast, wildfire zones, floodplains, or high-crime areas can raise rates and deductibles.

- Rebuild cost: Higher replacement cost equals higher premium.

- Roof age and material: Newer roofs and impact-resistant materials can lower rates.

- Electrical, plumbing, and heating systems: Updates reduce risk of fire or water damage.

- Claims history: Prior claims may affect eligibility and pricing.

- Credit-based insurance score (in many states): Linked to claims frequency; regulated or prohibited in some jurisdictions.

- Attractive nuisances: Pools, trampolines, or certain dog breeds can trigger underwriting restrictions or higher premiums.

- Security and mitigation: Monitored alarms, water shutoff devices, leak sensors, wildfire-resistant landscaping, and fortified roofing can earn discounts.

Industry research from organizations such as the Insurance Information Institute and the National Association of Insurance Commissioners highlights rising catastrophe losses, higher reinsurance costs, and construction inflation as key pressures. In some regions, insurers are tightening underwriting, raising deductibles, and incentivizing mitigation. Programs like IBHS FORTIFIED roofing standards, defensible space for wildfire, and water shutoff technology are increasingly recognized with meaningful credits. These trends underscore why understanding the types of coverage for home insurance—and tailoring them to your property and region—has never been more important.

How to choose the right policy for your home

Shopping on price alone can be costly later. Use this process to align coverage with risk and budget:

- Establish your rebuild cost: Work with your agent or insurer to detail materials, finishes, and square footage. Update after renovations.

- Select the right dwelling option: Consider extended or guaranteed replacement cost for added resilience.

- Upgrade personal property to replacement cost: Avoid ACV payouts that fall short when you need to replace items.

- Match endorsements to your risk: Water backup for finished basements, service line for older homes, ordinance or law for older neighborhoods, and scheduled coverage for valuables.

- Review liability limits: Choose at least $300,000 to $500,000; add an umbrella if you have significant assets or increased exposure (pool, hosting, teen drivers in the household).

- Confirm deductibles you can afford: Remember that percentage deductibles can be large after storms.

- Ask about discounts: Bundling home and auto, monitored alarms, smart leak detection, impact-resistant roofs, and claims-free discounts can meaningfully reduce costs.

- Compare policy forms: An HO-5 may be worth the premium if you want broader protection on personal property.

- Work with a knowledgeable agent: Independent agents can compare multiple carriers and explain differences in the types of coverage for home insurance.

Claims tips: what to do when something goes wrong

After a loss, your actions can influence the outcome of your claim:

- Protect property: Take reasonable steps to prevent further damage (board up windows, shut off water). Keep receipts—these are typically reimbursable.

- Document thoroughly: Photograph and video damage, inventory affected items, and save receipts for temporary housing and repairs.

- Report promptly: Notify your insurer as soon as practical; ask about emergency services vendors if needed.

- Get repair estimates: Independent estimates help validate scope and cost.

- Understand depreciation and recoverable holdback: For replacement cost claims, you may receive ACV first and the balance after proof of repair or replacement.

- Escalate respectfully: If you disagree with an adjuster’s scope or price, request a reinspection, use the appraisal clause where available, or consult a licensed public adjuster or attorney for complex disputes.

Expert insights and current realities

Home insurance is evolving as severe weather events increase in frequency and intensity in many regions. Analysts point to higher reinsurance costs and rebuilding inflation as reasons some carriers are limiting new business or non-renewing in high-risk ZIP codes. In wildfire and hurricane zones, mitigation is increasingly rewarded: fire-resistant roofing, ember-resistant vents, defensible space, and water shutoff devices are examples. Pairing strong mitigation with the right endorsements—especially water backup, ordinance or law, and extended replacement cost—can be the difference between a manageable setback and a financial shock.

Consumer surveys consistently show that many homeowners underestimate rebuild costs and overestimate what their policy covers. To avoid this gap, revisit your coverage after renovations, major purchases, or changes in local building codes. Ask your agent to walk you through scenarios specific to your property and region. When comparing the types of coverage for home insurance among carriers, look beyond the premium to claims handling reputation, financial strength, and available risk mitigation programs.

Frequently asked questions

Is my home-based business covered?

Standard policies provide limited coverage for business property and typically exclude business liability. If clients visit your home or you store inventory, ask about home business endorsements or a separate business policy.

Are high-value items like engagement rings or art fully covered?

Not without scheduling. Most policies cap theft coverage for jewelry and similar items at relatively low sublimits. Scheduling adds coverage for mysterious disappearance and often removes the deductible.

What if I own a condo?

Condo policies (HO-6) cover your unit’s interior (walls-in), personal property, loss of use, and liability. Review your association’s master policy to coordinate coverage and consider loss assessment coverage for shared property losses.

What if I rent my home or a room on a short-stay platform?

Short-term rentals change your risk profile. Many insurers require a specific endorsement, a home-sharing rider, or a landlord policy (DP-3) for whole-home rentals. Platform guarantees are not a substitute for insurance.

How are older homes handled?

Older homes may have higher rebuild costs due to craftsmanship and materials. Ordinance or law coverage helps with code upgrades; some insurers offer modified replacement cost for antique features. Clarify valuation before you buy.

Does my policy cover floods or earthquakes?

Typically no—those require separate policies or endorsements. Even outside high-risk maps, heavy rain events can cause surface water flooding, and earthquake risk exists in more regions than many homeowners realize.

Putting it all together

Homeowners insurance works best when it’s tailored. Start with solid dwelling limits based on current rebuilding costs, upgrade personal property to replacement cost, and layer on endorsements that match your home’s unique exposures. Choose robust liability limits and consider an umbrella policy if you have significant assets or risk factors like a pool. As you compare quotes, look closely at policy forms, deductibles, and how each insurer addresses the types of coverage for home insurance that matter most to you.

If you take one step today, request a coverage review with your agent. Bring a quick home inventory, recent renovation details, and questions about water backup, service line, and ordinance or law coverage. The most effective strategy combines prevention—roof upgrades, leak detection, defensible space—with a policy built for real-world risks. That clarity now pays dividends when it matters most.

Key takeaways to guide your next decision

- Insure to rebuild cost, not market value; consider extended or guaranteed replacement cost.

- Upgrade to replacement cost for personal property and schedule valuables to lift sublimits.

- Add endorsements that close common gaps: water backup, service line, ordinance or law, and matching siding/roof.

- Review liability limits and consider a personal umbrella for extra protection.

- Mind special deductibles for wind, hail, or hurricanes; ensure you can afford them.

- Leverage mitigation for discounts: impact-resistant roofing, monitored alarms, and water shutoff devices.

- Revisit coverage after renovations, major purchases, or code changes.

As markets shift and weather risks evolve, staying informed about the types of coverage for home insurance helps you protect your home, your budget, and your peace of mind. Use this guide as a checklist for your next renewal and as a conversation starter with your agent.

Final word: an informed homeowner is a resilient homeowner

Insurance is a promise on paper until the day you need it. Reading the fine print, asking specific questions, and balancing premiums with meaningful protections isn’t just smart—it’s essential. With a clear grasp of the types of coverage for home insurance, you can shape a policy that reflects today’s realities and supports a faster, fuller recovery after a loss.