Filed under Home Insurance on

Understanding Equipment Breakdown Coverage for Home Insurance

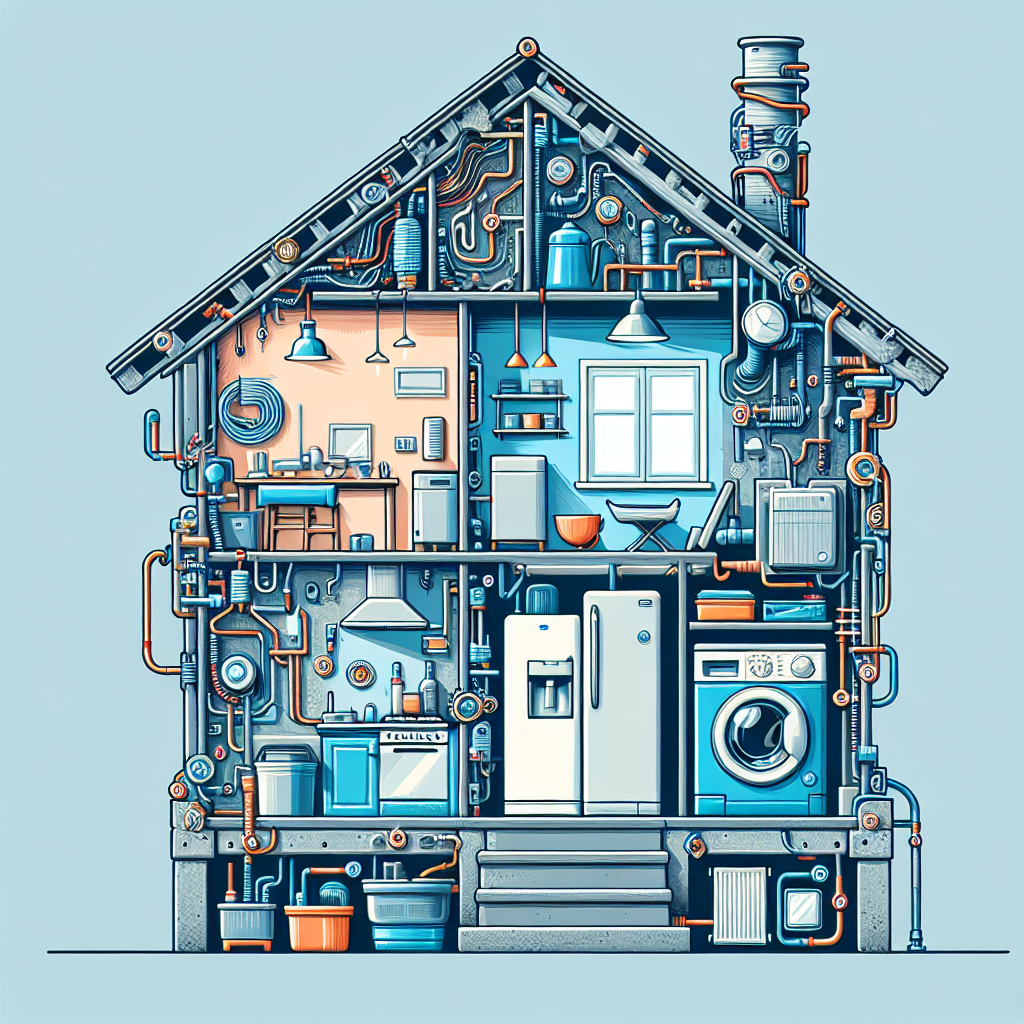

When it comes to safeguarding your home, a comprehensive insurance plan can serve as a financial lifesaver. One lesser-known but crucial aspect of a robust home insurance policy is Equipment Breakdown Coverage. This coverage often flies under the radar, but it can offer vital protection for homeowners. In this article, we’ll delve into what Equipment Breakdown Coverage is, why it matters, and how it can be a game-changer for your home insurance package.

What is Equipment Breakdown Coverage?

Equipment Breakdown Coverage, sometimes referred to as mechanical breakdown insurance, is designed to cover the costly repair or replacement of essential home systems and appliances if they fail due to mechanical or electrical issues. This type of coverage fills the gap left by traditional home insurance policies, which typically do not cover such breakdowns unless combined with specific endorsements.

The Scope of Coverage

This coverage is quite comprehensive and can include:

- Heating, ventilation, and air conditioning (HVAC) systems

- Refrigerators and freezers

- Washers and dryers

- Computers and other electronic devices

- Water heaters and boilers

- Electrical panels and home security systems

It essentially covers most household items that use electrical or mechanical power.

Why Equipment Breakdown Coverage Matters

The value of Equipment Breakdown Coverage becomes apparent when you consider the potential costs associated with repairing or replacing major household systems and appliances. Without this coverage, homeowners might have to pay out-of-pocket for these unexpected expenses.

Protection from Unexpected Costs

A sudden HVAC system failure during peak summer or winter months can lead to steep repair bills. Equipment Breakdown Coverage can alleviate these financial burdens, ensuring you aren’t left vulnerable to unexpected costs.

Enhanced Home Value

Protecting the functionality of home systems not only offers peace of mind but also maintains and potentially increases the value of your home. Prospective buyers see a well-maintained, insured property as a more appealing option.

How Does Equipment Breakdown Coverage Work?

Understanding the mechanics of Equipment Breakdown Coverage can help you make informed decisions about your home insurance policy.

Policy Integration and Claims Process

Typically, Equipment Breakdown Coverage is an add-on to your existing home insurance policy. Homeowners can opt for this coverage during policy renewal or when first signing up for insurance. When a breakdown occurs, filing a claim usually involves:

- Assessing the damage or malfunction.

- Contacting your insurance provider to initiate a claim.

- Following instructions for repair or replacement as per the insurer’s guidance.

- Paying any applicable deductibles as outlined in your policy.

- Receiving compensation or direct cover for repairs.

Cost and Deductibles

The cost for Equipment Breakdown Coverage is relatively modest, typically adding only a small premium to your existing policy. Deductibles vary but are often lower than those associated with other types of claims, making this an accessible form of protection for many homeowners.

Common Misconceptions About Equipment Breakdown Coverage

Despite its benefits, many homeowners misunderstand Equipment Breakdown Coverage. Let’s address some common misconceptions:

It’s the Same as a Home Warranty

While similar in providing financial coverage for appliance and system failures, a home warranty is a separate product that often limits the extent and scope of coverage. Equipment Breakdown Coverage is an insurance add-on and typically offers broader protection.

Doesn’t Cover Wear and Tear

Routine wear and tear or failures from improper maintenance are indeed not covered. This coverage is meant for sudden, unforeseen breakdowns due to mechanical or electrical failures.

Industry Trends and Expert Opinions

Experts predict an increasing demand for Equipment Breakdown Coverage as homeowners become more aware of its benefits and as household systems become more complex and indispensable.

Technical Advancements

As technology advances, homes are becoming more interconnected, making Equipment Breakdown Coverage even more relevant. Systems like smart home technologies and interconnected appliances present challenges best addressed by this kind of coverage.

Expert Insights

Insurance specialists often recommend adding Equipment Breakdown Coverage to protect against the rising costs of repairs and the technical complexity of modern appliances.

Deciding If Equipment Breakdown Coverage Is Right for You

Is this coverage necessary for your home? Consider the following when making your decision:

Assessment of Home Systems

- Age and condition of appliances

- Cost of potential repairs

- Overall reliance on electrical and mechanical systems

Evaluating Financial Implications

Review your budget to determine if the potential savings on repair costs outweigh the added premium. A small monthly increase in your insurance bill could translate to significant savings during an equipment failure.

Conclusion

Equipment Breakdown Coverage offers a safety net for the inevitable breakdowns of essential home systems and appliances, ensuring you’re not caught off guard by unexpected expenses. With the intricate systems found in modern homes, this coverage not only supports financial security but also peace of mind. By understanding its benefits, you can make a more informed decision about including Equipment Breakdown Coverage in your home insurance policy.