Filed under Home Insurance on

Understanding State Farm Home Insurance Coverages

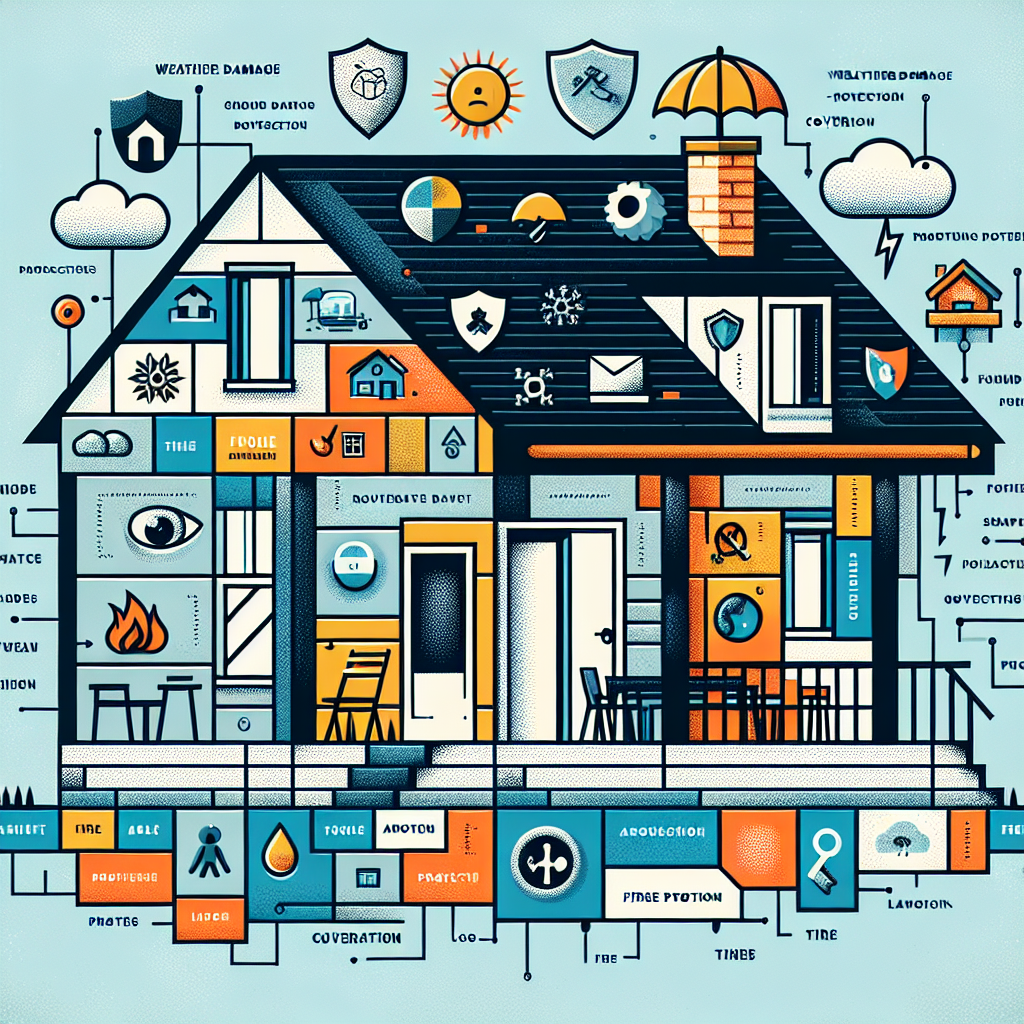

When considering the protection of your most prized possession—your home—understanding the nuances of insurance options becomes paramount. State Farm Home Insurance offers diverse coverages tailored to safeguard homeowners against unexpected events. This comprehensive guide deciphers these coverages, providing clarity and insight into how they function.

What is State Farm Home Insurance?

State Farm Home Insurance provides a safety net for homeowners, covering a multitude of scenarios that could lead to financial distress. This coverage typically includes protection for your dwelling, personal property, liability, and additional living expenses. By evaluating each aspect, you can determine the best level of protection for your needs.

Key Elements of State Farm Home Insurance Coverages

Dwelling Coverage

The cornerstone of any home insurance policy, dwelling coverage safeguards the physical structure of your home. In the event of damage caused by risks such as fire, storms, or vandalism, State Farm promises financial support to cover necessary repairs or rebuilding. Understanding the replacement cost of your home is crucial to ensure you choose adequate coverage.

Personal Property Coverage

Your home is more than just walls and a roof; it's what is inside that holds significant personal value. Personal property coverage extends to the contents of your home, including furniture, electronics, and clothing. Assess your belongings and opt for a policy that reflects their worth, perhaps considering an inventory for added accuracy.

Liability Protection

Accidents can happen unexpectedly, even to guests within your home. Liability protection is designed to shield you from financial loss should you be legally responsible for someone else's injuries or property damage. This coverage is essential as it covers legal fees and medical expenses, preventing potential financial burdens.

Medical Payments Coverage

Medical payments coverage is a thoughtful addition, offering a degree of protection for minor injuries incurred by visitors on your property. It provides quick financial relief to cover medical bills, regardless of who is at fault, promoting goodwill and avoiding potential legal challenges.

Additional Living Expenses

If your home becomes uninhabitable due to a covered loss, additional living expenses coverage aids in managing the cost of temporary accommodations. State Farm Home Insurance ensures you and your family maintain a standard level of comfort while your home undergoes repairs.

Optional Coverages for Enhanced Protection

Recognizing the unique needs of homeowners, State Farm offers optional coverages beyond the standard offerings. These enhancements provide more expansive protection against risks that might otherwise fall outside typical coverage parameters.

Flood Insurance

It's vital to note that standard home insurance policies do not cover flood damage. To bridge this gap, State Farm provides potential access to separate flood insurance through the National Flood Insurance Program (NFIP), vital for those in flood-prone areas.

Earthquake Coverage

Similarly, homeowners in regions susceptible to seismic activity might consider earthquake coverage. This option ensures financial support for structural repairs and personal property damage caused by earthquakes, offering peace of mind when the ground shakes.

Valuable Personal Property

For high-value items like jewelry, art, or rare collectibles, additional coverage can be added to your policy. This ensures these items are safeguarded against loss beyond the limitations of typical personal property coverage.

Key Considerations When Choosing State Farm Home Insurance

Choosing the right home insurance policy involves a blend of understanding your needs and evaluating coverage options. Consider the following factors to make an informed decision:

- Location: Proximity to natural hazard zones can impact coverage needs and premiums.

- Home Value: An accurate evaluation of your home's replacement cost guides appropriate dwelling coverage.

- Personal Belongings: Conducting a detailed inventory helps in selecting suitable personal property coverage.

- Budget: Balancing premium costs with comprehensive protection ensures financial readiness in a crisis.

The Insurance Claim Process with State Farm

Navigating the claims process efficiently maximizes your policy benefits and ensures swift resolutions. Here’s a step-by-step guide to managing claims with State Farm:

- Report the Claim: Promptly contact State Farm via phone, app, or online to report damage or loss.

- Document the Damage: Take photos and gather evidence to support your claim, aiding the assessment process.

- Claim Assessment: A claims adjuster evaluates the damage and guides you through the next steps.

- Review & Decision: State Farm reviews the claim details and communicates its decision, including any settlement offer.

- Resolution: Upon approval, receive payment for covered losses, assisting in recovery and rebuilding.

Why Choose State Farm Home Insurance?

State Farm is celebrated for its robustness and customer service excellence. Its expansive network of local agents ensures personalized attention and answers to pressing insurance queries, bolstering trust and reliability over time.

Furthermore, policyholders may benefit from discounts for bundling home and auto insurance, maintaining a history of no claims, or implementing home safety features like security systems. These benefits empower homeowners to tailor cost-effective policies without compromising on peace of mind.

Conclusion

Decoding State Farm Home Insurance coverages reveals the breadth of protection available to homeowners against unforeseen challenges. By understanding dwelling, personal property, liability, and optional coverage options, you can secure a policy that matches your life's unique landscape. Always evaluate your property's needs and consult State Farm agents to align your coverage with your personal priorities. Ensuring comprehensive home insurance guarantees that your home remains a haven, no matter what life brings.