Filed under Auto Insurance on

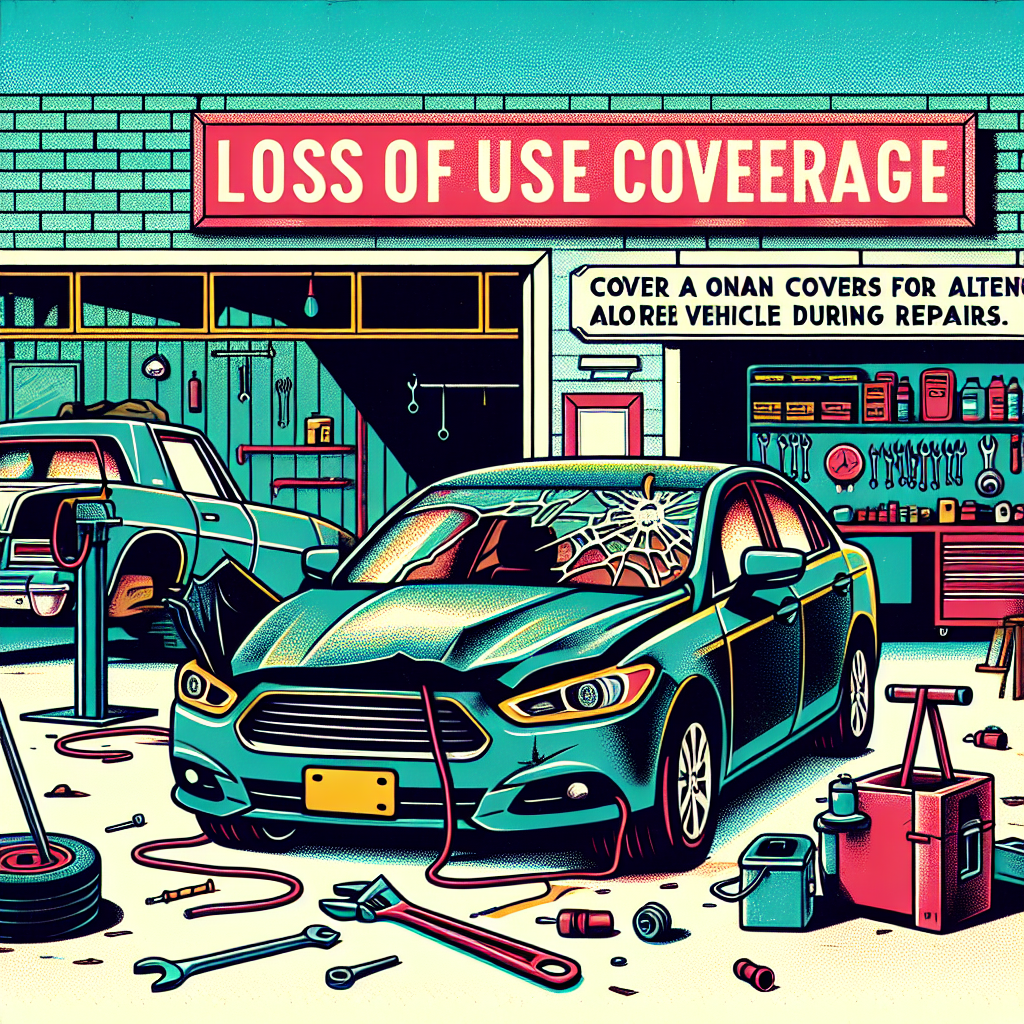

What Is Loss of Use Coverage on Auto Insurance?

When your vehicle is suddenly out of commission after an accident, life doesn’t pause. You still need to get to work, pick up the kids, and run errands. That’s where a specific type of protection steps in: loss of use coverage on auto insurance. Understanding how this coverage works can be the difference between a manageable inconvenience and a major financial headache.

Understanding Loss of Use Coverage on Auto Insurance

Loss of use coverage on auto insurance is designed to help pay for transportation expenses when your vehicle is undriveable due to a covered claim. While many drivers are familiar with rental reimbursement, fewer fully grasp what loss of use means, how it’s triggered, and what limitations apply.

In practical terms, this coverage kicks in after an insured incident—such as a collision or comprehensive claim—when your car is in the shop or declared a total loss. Instead of absorbing the full cost of temporary transportation, you can lean on your insurance policy up to the limits you’ve chosen.

How Loss of Use Coverage Works

Loss of use coverage on auto insurance typically follows a straightforward process, but the details matter:

A covered claim occurs. Your vehicle is damaged by an event covered by your policy, such as a crash, theft, vandalism, or a severe weather incident (depending on your coverage types).

Your car becomes undriveable or is in repair. The vehicle either isn’t safe to operate or must stay at a repair facility for a qualifying period.

You incur transportation expenses. You rent a vehicle, use rideshare services, or rely on public transportation while your car is unavailable.

Your insurer reimburses you. The insurance company pays for those costs up to your daily and total limits, subject to your policy terms.

Importantly, loss of use coverage on auto insurance doesn’t apply for routine maintenance, mechanical breakdowns, or voluntary downtime. It’s specifically tied to an insurance-covered loss.

Types of Transportation Covered

Loss of use coverage is often associated only with rental cars, but many modern policies are more flexible. Depending on your insurer and state regulations, you may be able to use this coverage for:

Rental cars: The most common option, with daily and maximum limits (for example, $30 per day up to $900 per claim).

Rideshare and taxis: Some insurers allow reimbursement for services like Uber, Lyft, or traditional taxi companies instead of or in addition to a rental.

Public transportation: Bus, train, or subway fare may be eligible if they serve as your primary temporary transportation.

Car sharing services: In certain markets, short-term car share programs can qualify as reimbursable alternatives.

Always verify with your insurer which options are accepted. The flexibility of loss of use coverage on auto insurance has grown in recent years as consumer behavior shifts and ride-hailing becomes more widespread.

Loss of Use vs. Rental Reimbursement: Are They the Same?

Many drivers use the terms interchangeably, but there can be subtle differences depending on the insurer and state law. In some policies, loss of use coverage on auto insurance is explicitly described as rental reimbursement. In others, “loss of use” may refer more broadly to the insurer’s responsibility to compensate for the lack of your vehicle, not just the literal cost of a rental car.

Key distinctions to pay attention to include:

Coverage scope: Rental reimbursement may focus only on rental car costs, while broader loss of use wording can allow for rideshare or public transit reimbursement.

Triggering events: Some policies offer loss of use only after specific types of covered losses, while rental reimbursement might be linked directly to collision or comprehensive claims.

Payment methodology: Loss of use may involve either direct billing with a rental company or reimbursement after you submit receipts.

The safest approach is to review your declarations page and policy documents or speak directly with your agent to clarify how loss of use coverage is defined in your particular contract.

When Does Loss of Use Coverage Apply?

Loss of use coverage on auto insurance generally becomes available only under certain conditions. Typical triggers include:

Collision claims: Repairs after a crash that you cause, or where fault is not yet determined, often fall under collision coverage. If your vehicle is undriveable, your loss of use benefit can apply once your collision claim is approved.

Comprehensive claims: Non-collision events such as theft, hail damage, fire, falling objects, or animal impacts may activate comprehensive coverage—and with it, your loss of use benefit.

Total loss scenarios: If your car is declared a total loss, loss of use may help cover transportation costs until you receive settlement and can replace your vehicle, within policy time limits.

However, there are clear situations where loss of use coverage on auto insurance does not apply:

Routine mechanical failures (e.g., transmission breakdown).

Scheduled maintenance or voluntary upgrades.

Periods where the vehicle is technically drivable but you choose not to use it.

Claims not covered by your policy, such as excluded drivers or intentional damage.

Policy Limits and Duration

Most insurers structure loss of use coverage with both daily and maximum limits. A common configuration might look like this:

$30 to $50 per day.

$600 to $1,500 per covered claim.

The duration is typically tied to the reasonable repair time or the settlement period for a total loss. If the repair shop needs 10 days, your policy will generally cover transportation during those 10 days, up to your daily and total caps.

It’s worth noting that delays unrelated to the actual repair—such as waiting weeks to schedule the appointment—may not all be covered. Some insurers rely on standardized repair time estimates to decide how long they will fund loss of use costs, regardless of real-world delays like parts shortages.

Who Needs Loss of Use Coverage?

Loss of use coverage on auto insurance is especially valuable if being without your car even for a few days would create serious disruption. You’re more likely to benefit if you:

Have a single household vehicle with no backup transportation.

Commute to work or school in areas with limited public transit.

Regularly transport children, older family members, or clients.

Use your vehicle for gig work or part-time commercial purposes (subject to policy rules).

Conversely, if you live in a city with robust public transportation, have multiple vehicles, or work remotely, you may decide that a higher daily rental limit is not essential. However, even in those situations, a modest level of loss of use coverage on auto insurance can provide peace of mind at a relatively low cost.

Cost of Adding Loss of Use Coverage

The premium for this coverage is usually modest when compared to core protections like collision and liability. Industry data and insurer disclosures often show an annual range such as:

Approximately $20 to $80 per year, depending on your chosen limits, state, vehicle type, and insurer.

Factors that may influence the price include:

Your driving history and claims record.

The value and class of vehicle you typically rent as a replacement.

Whether you live in an area with higher rental car costs.

How your insurer packages optional coverages.

From a financial planning standpoint, loss of use coverage on auto insurance is often considered a high-value, low-cost add-on, particularly for households that rely heavily on a single vehicle.

Industry Trends and Evolving Coverage Options

The landscape around temporary transportation benefits is shifting as consumer habits and mobility solutions evolve. Several notable trends are emerging:

Integration with rideshare: More insurers are explicitly allowing policyholders to use rideshare services as part of their loss of use claim, reflecting growing demand for flexible, on-demand transportation.

Digital claim handling: Mobile apps, instant rental reservations, and direct billing arrangements streamline how drivers access benefits and reduce out-of-pocket delays.

Usage-based coverage: Telematics and pay-per-mile policies sometimes bundle or customize loss of use coverage based on risk data and driving patterns.

Experts in the auto insurance industry frequently highlight loss of use coverage as a key component of a more holistic protection strategy, especially as vehicles become more complex and repair times lengthen due to technology, parts availability, and labor constraints.

How to File a Loss of Use Claim

Knowing how to navigate the claims process can help you maximize your benefits and avoid unnecessary out-of-pocket costs. When you need to use loss of use coverage on auto insurance, follow these general steps:

Report the accident or incident promptly. Contact your insurer as soon as it’s safe to do so and provide accurate details about the event.

Confirm your coverage. Ask specifically about your loss of use or rental reimbursement limits, daily caps, and approved transportation options.

Use preferred providers if recommended. Many insurers partner with rental companies for direct billing. This can reduce paperwork and upfront costs.

Keep clear documentation. Save all receipts, rental agreements, transit passes, and rideshare invoices as proof of your expenses.

Submit expenses on time. Follow your insurer’s instructions for digital uploads, email submissions, or physical mail, and note any deadlines.

Be sure to ask your adjuster how long your loss of use benefits will remain active, especially if repair timelines are uncertain or if a total loss evaluation is pending.

Limitations, Exclusions, and Common Pitfalls

Loss of use coverage on auto insurance offers substantial convenience, but it’s not unlimited. Common limitations include:

Daily caps: If you choose a luxury or premium rental above your qualifying class, you may be responsible for the difference.

Coverage start date: Some policies only begin paying from the date repairs actually start, not from the date of the accident.

Geographic restrictions: There may be conditions related to out-of-state rentals or international travel.

Non-covered drivers: If someone not listed or excluded on your policy causes the loss, your benefit could be reduced or denied.

A frequent mistake is assuming loss of use protection applies to every scenario where your car is unavailable. That’s not the case. Reviewing your policy language annually and asking your agent direct questions can prevent unpleasant surprises.

Loss of Use in At-Fault vs. Not-At-Fault Accidents

Fault can affect how and from whom you recover temporary transportation costs:

If you are at fault: You typically rely on your own loss of use coverage on auto insurance, assuming you’ve added this option to your policy.

If the other driver is at fault: In many states, you can seek reimbursement from the at-fault driver’s liability insurance for your rental or transportation costs, with or without your own loss of use coverage.

Using your own coverage can sometimes help you get back on the road faster, while your insurer later recovers costs from the at-fault party’s insurer through subrogation.

How Much Loss of Use Coverage Should You Choose?

Selecting appropriate limits is a balancing act between cost and convenience. To decide what level of loss of use coverage on auto insurance makes sense for you, consider these factors:

Typical rental rates in your area: Prices can vary significantly by city and region. Check local averages for a comparable vehicle class.

Your daily commuting needs: If you travel long distances or at unusual hours, rideshare or transit may be less practical, and a rental car limit that truly covers costs becomes more important.

Household backup options: Additional vehicles or reliable carpool arrangements may allow you to select lower limits.

Budget and risk tolerance: Estimate the potential expense of being without your car for 10 to 20 days and weigh it against the modest premium increase for higher limits.

Many insurance professionals suggest choosing a daily limit that realistically covers a mid-size rental in your area for at least two weeks. This provides a cushion for longer repair times or claims processing delays.

Key Takeaways: Why This Coverage Matters

Loss of use coverage on auto insurance might not be the first thing you think about when buying a policy, but it can be one of the most immediately practical protections when an accident happens. It exists to:

Keep your daily life on track while your car is repaired or replaced.

Reduce financial stress from unexpected transportation costs.

Offer flexible options through rental cars, rideshare, or public transit, depending on your insurer’s rules.

Complement your collision and comprehensive coverage for a more complete safety net.

By understanding the details of loss of use coverage on auto insurance—how it works, when it applies, and what limits you need—you position yourself to handle vehicle downtime with confidence instead of chaos.

Before your next renewal, review your policy, examine your daily transportation needs, and speak with a licensed agent or insurance professional about whether your current loss of use benefits are sufficient. A small adjustment today can provide substantial savings and convenience when you need it most.