Filed under Business Insurance on

Essential Insights on Mobile Mechanic Business Insurance

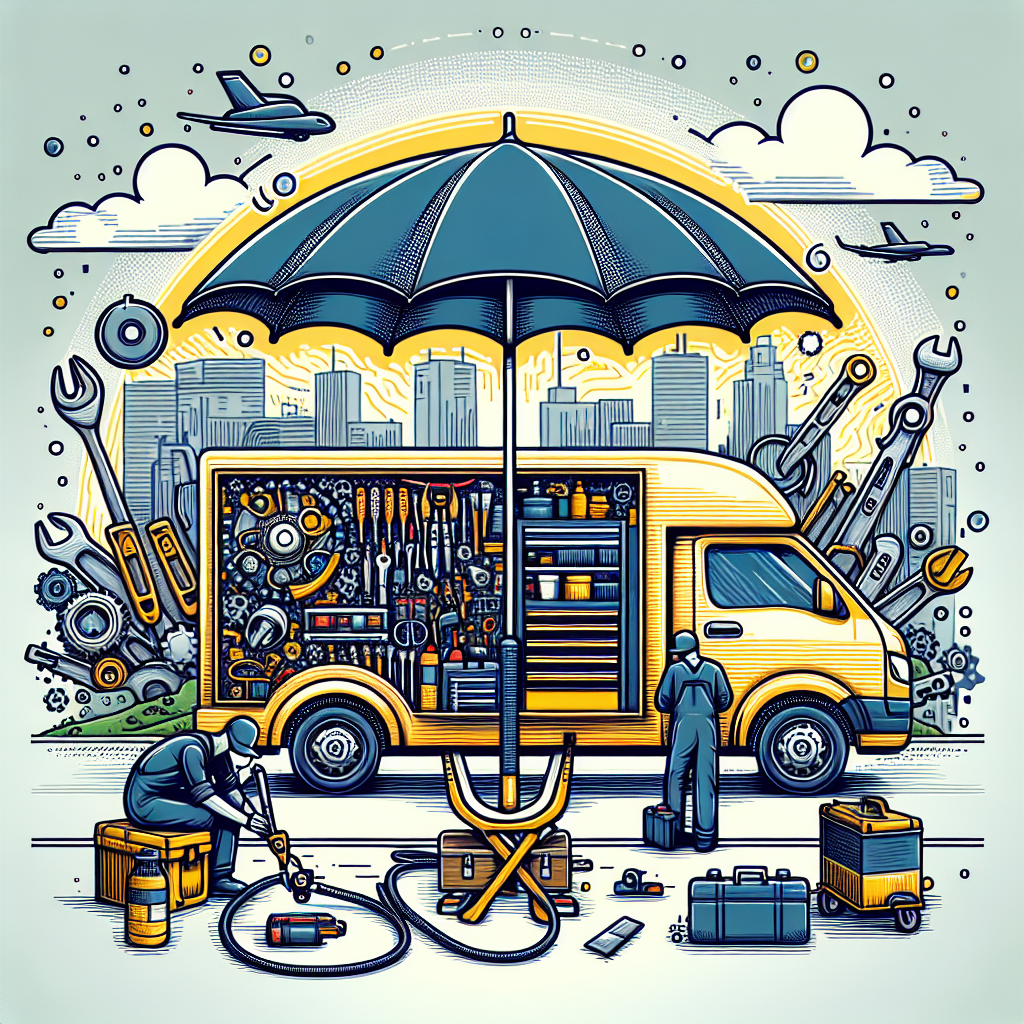

In today’s fast-paced world, the convenience of mobile mechanic services has revolutionized vehicle maintenance and repair. As this industry grows, so does the need for robust protection against risks specific to operating a mobile mechanic business. Mobile mechanic business insurance not only offers protection but also garners trust and credibility with clients. This article delves into essential insights surrounding mobile mechanic business insurance, highlighting why it’s crucial and how to optimize coverage effectively.

Understanding Mobile Mechanic Business Insurance

Mobile mechanic business insurance is a specialized form of coverage designed to protect mechanics who operate without a fixed location. Unlike traditional auto repair shops, mobile mechanics travel to clients, exposing them to unique risks that require tailored insurance solutions.

Why Mobile Mechanic Business Insurance Is Crucial

As a mobile mechanic, you're constantly on the move, often facing unpredictable circumstances. From potential vehicle accidents to damage during repairs, each service call presents a variety of risks. Mobile mechanic business insurance ensures that mechanics are shielded from financial losses due to accidents, damage to client property, or any liabilities arising from their work.

Key Components of Mobile Mechanic Business Insurance

- General Liability Insurance: This covers third-party claims related to property damage or bodily injury caused by your operations. It's essential for protecting against unexpected incidents that could lead to legal action.

- Commercial Auto Insurance: Given that the business involves travel, commercial auto insurance is fundamental. This policy covers damages related to your service vehicle, whether from accidents, theft, or vandalism.

- Professional Liability Insurance: This is crucial if a client claims that your repair or maintenance work caused damage or failed to fix the issue. It covers legal defense costs and any settlements or judgments.

- Tool and Equipment Coverage: Mobile mechanics rely heavily on their tools, which can be costly. This insurance covers the loss, theft, or damage of essential equipment, ensuring you’re not left without the tools needed for your job.

- Workers' Compensation Insurance: If you have employees, workers' compensation is required to cover medical expenses and lost wages if they're injured on the job.

Optimizing Your Mobile Mechanic Business Insurance

Finding the right coverage is pivotal in protecting your business against real-world risks. Here are ways to ensure your mobile mechanic business insurance is streamlined and effective:

Assess Your Risks

To understand the unique risks your business faces, consider factors like the areas you cover, the types of services offered, and the specific tools used. This assessment guides you in selecting policies that address your specific insurance needs.

Compare Insurance Providers

Not all insurance providers offer the same policies or premiums. Research different companies, seeking those with a strong reputation in the mobile mechanic industry. Consider premiums, coverage limits, and reviews to ensure you’re choosing the best fit for your business.

Bundle Policies for Discounts

Many insurance providers offer discounts if you bundle multiple policies. For example, combining commercial auto and general liability coverage can lead to significant savings. Bundling also simplifies management, as you’ll handle fewer documents and payments.

Regularly Review Your Coverage

Your business’s needs may change over time. It’s crucial to review your mobile mechanic business insurance annually or when you introduce new services or equipment. Regular reviews help in adjusting your coverage as your business evolves, maintaining optimal protection.

Industry Trends and Expert Insights

The mobile mechanic industry is expected to grow as more consumers seek convenient and flexible auto repair services. With this growth comes a heightened focus on safety, compliance, and liability. Experts emphasize the importance of digital tools in managing business operations, including insurance.

Utilizing Technology

Modern mobile mechanics are increasingly using digital platforms for invoicing, client management, and even remote diagnostics. These technologies also assist in documenting services, which is invaluable should an insurance claim arise. Comprehensive records facilitate smoother claim processes and ensure disputes are resolved efficiently.

Enhancing Customer Trust

Having adequate mobile mechanic business insurance can enhance client confidence. Promoting your insurance coverage in marketing materials can set you apart from uninsured competitors, emphasizing your professionalism and reliability. Clients are more likely to choose mechanics who prioritize both safety and accountability.

Common Misconceptions About Mobile Mechanic Business Insurance

Despite its importance, there are several misconceptions about mobile mechanic business insurance that can hinder businesses from getting appropriate coverage.

Believing Personal Auto Insurance is Sufficient

Some mobile mechanics might assume their personal auto insurance plans cover business operations. However, personal policies typically exclude commercial activities, potentially leaving you unprotected in the event of a business-related incident.

Underestimating the Value of Professional Liability Insurance

Many mechanics overestimate their workmanship's security. However, professional liability insurance becomes invaluable in cases of overlooked or unforeseen errors. It safeguards against potential lawsuits, ensuring your business remains operational despite claims.

Thinking Small-Scale Operations Don’t Need Coverage

No matter how small the operation, risks are ever-present. Even part-time mobile mechanics can face unexpected challenges requiring insurance assistance. Comprehensive coverage ensures that even minimal liabilities do not grow into significant financial burdens.

Finding the Right Insurance Partner

Choosing the right insurance provider can significantly impact your mobile mechanic business’s security. Look for insurance companies with extensive experience in the auto service industry and seek recommendations from fellow mechanics. Attending industry conferences or joining mechanic associations can provide insights into insurers who are well-regarded in the community.

Partnering with an Insurance Broker

Consider working with an insurance broker who specializes in commercial policies. Brokers can offer personalized advice, ensure competitive pricing, and simplify the policy application process, helping you focus more on growing your business than on administrative concerns.

Conclusion

Mobile mechanic business insurance stands as a cornerstone of a successful mechanical service. By understanding your unique risks, exploring coverage options, and staying informed about industry trends, your business can thrive while being protected against unforeseen challenges. As the mobile mechanic industry evolves, maintaining comprehensive and adaptive insurance will safeguard your reputation and financial future.