Filed under Home Insurance on

Calculating Home Insurance Coverage: A Step-by-Step Guide

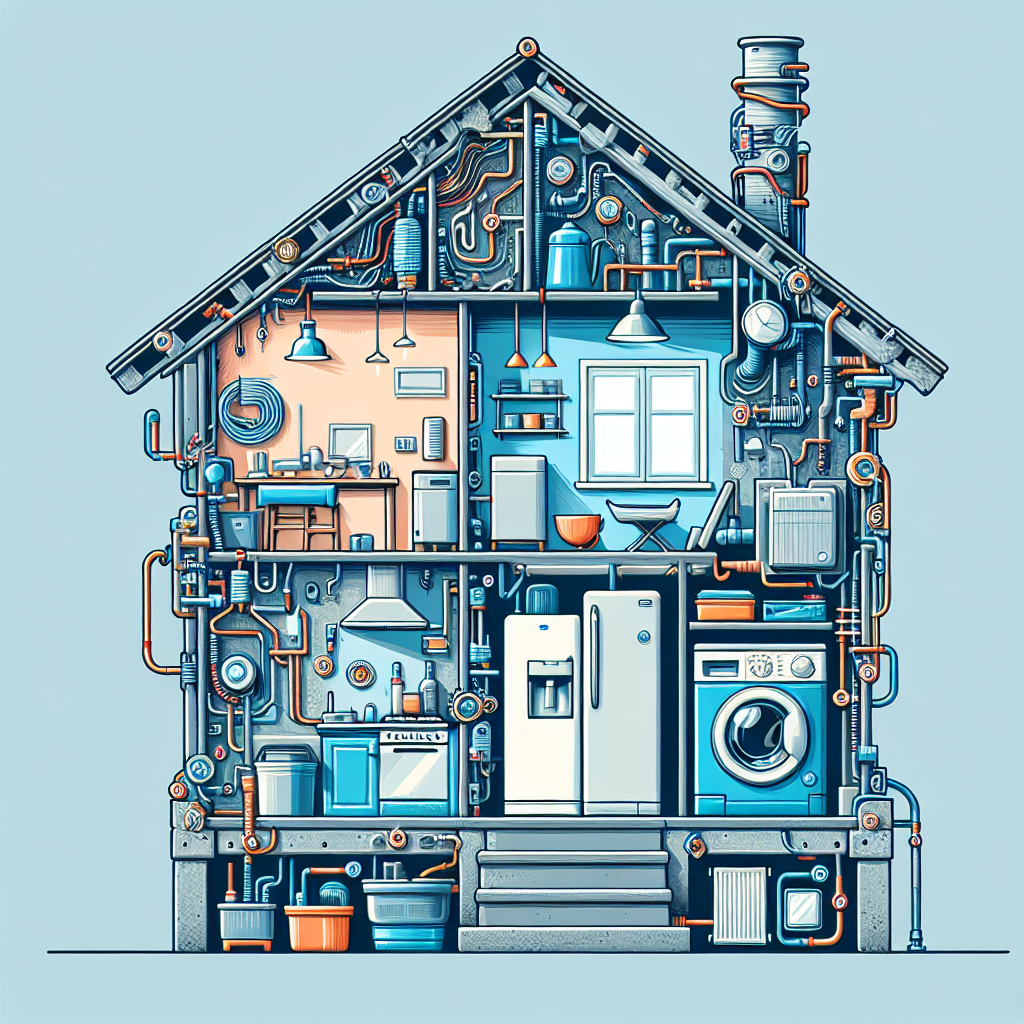

When it comes to safeguarding your most valuable investment—your home—understanding the complexities of home insurance coverage is crucial. Not only does it protect your house, but it also covers your personal belongings and provides liability protection. Yet, many homeowners find themselves puzzled by the intricacies of calculating the right coverage amount. This comprehensive guide walks you through the step-by-step process of calculating home insurance coverage, ensuring you make informed decisions that give you peace of mind.

Understanding the Basics of Home Insurance Coverage

Home insurance is designed to protect against financial loss in the event of damage or destruction. It is essential to know what is included in the policy to make accurate calculations for your coverage needs. Typically, it comprises several components:

- Dwelling Coverage: Protects the physical structure of your home.

- Personal Property Coverage: Covers your personal belongings.

- Liability Protection: Shields you against lawsuits for injuries or damages.

- Additional Living Expenses: Covers temporary housing if your home becomes uninhabitable.

Determine the Replacement Cost of Your Home

The first step in calculating home insurance coverage is determining the replacement cost of your dwelling. This figure represents the expense of rebuilding your home from the ground up, using the same quality of materials. Distinct from the market value, which fluctuates with real estate trends, the replacement cost focuses solely on the construction aspect.

- Consult a Professional: Hire a professional appraiser or use online calculators for a reliable estimate.

- Consider Unique Features: Account for unique architectural features or custom installations in your assessment.

- Update Regularly: Re-evaluate your replacement cost periodically to keep up with inflation and renovations.

Account for Personal Property

As you calculate home insurance coverage, consider the value of your personal belongings. Generally, personal property coverage is set at 50-70% of your dwelling coverage limit. However, high-value items may need additional endorsements.

- Create an Inventory: Document all belongings, complete with descriptions and values.

- Utilize Technology: Apps and software can assist in managing your home inventory.

- Evaluate Replacement Value vs. Actual Cash Value: Decide if you want reimbursement based on replacement cost or actual cash value, considering depreciation.

Consider Liability Protection

Liability protection is an often-overlooked aspect when calculating home insurance coverage. This component covers legal fees and settlements in case of injuries or property damages caused by negligence.

- Assess Your Risk: Consider factors such as your home’s layout, pets, or potentially risky aspects like swimming pools.

- Aim Higher: Opt for coverage that exceeds the standard policy limit to shield yourself against substantial claims.

- Umbrella Policies: Consider umbrella insurance for extended liability protection.

Understanding Additional Living Expenses (ALE)

Additional Living Expenses coverage plays a critical role if your home becomes uninhabitable due to covered perils. This feature aids in maintaining your standard of living while your home undergoes repairs.

- Evaluate Needs: Consider family size and temporary housing expenses.

- Check Policy Limits: Understand any caps on ALE to avoid unexpected out-of-pocket costs.

- Keep Records: Maintain receipts and documentation for all ALE-related expenses.

Insurance Riders and Endorsements

While standard policies cover many aspects, certain elements may require additional endorsements or riders. These amend your existing policy to cover special items or circumstances.

- High-Value Items: Coverage for jewelry, artwork, or collectibles often needs a rider.

- Severe Weather: In areas prone to floods or earthquakes, specific endorsements might be essential.

- Water Backup: Consider a rider for sump pump failures or sewer backups.

Reviewing Your Home Insurance Policy

Regular reviews of your policy can ensure it aligns with your evolving needs. Life changes, such as home renovations or acquiring valuable items, warrant a re-evaluation.

- Annual Assessments: Conduct yearly reviews with your insurance agent.

- Adjust for Inflation: Confirm that your coverage adjusts for inflation to maintain adequate protection.

- Explore Discounts: Inquire about bundling policies or security system discounts.

Industry Trends and Expert Opinions

Staying informed about industry trends can guide your decisions when calculating home insurance coverage. Here’s what the experts are saying:

- Climate Change Impact: Increased weather-related catastrophes have prompted insurers to adjust risk assessments. Consider more comprehensive or specialized coverage accordingly.

- Tech Integration: Smart home technology may not only enhance security but might also result in premium discounts.

- Policy Customization: An emerging trend towards customizable insurance solutions allows you to tailor coverage to precise needs.

Calculating home insurance coverage isn’t merely about ticking boxes; it’s about ensuring security and confidence in your home’s protection. By understanding and implementing these steps, you can forge a policy that accommodates your unique requirements. Stay proactive, review consistently, and remain alert to changes in the industry landscape, effectively balancing risk with peace of mind.