Filed under Home Insurance on

USAA Insurance Home Protector Coverage Explained

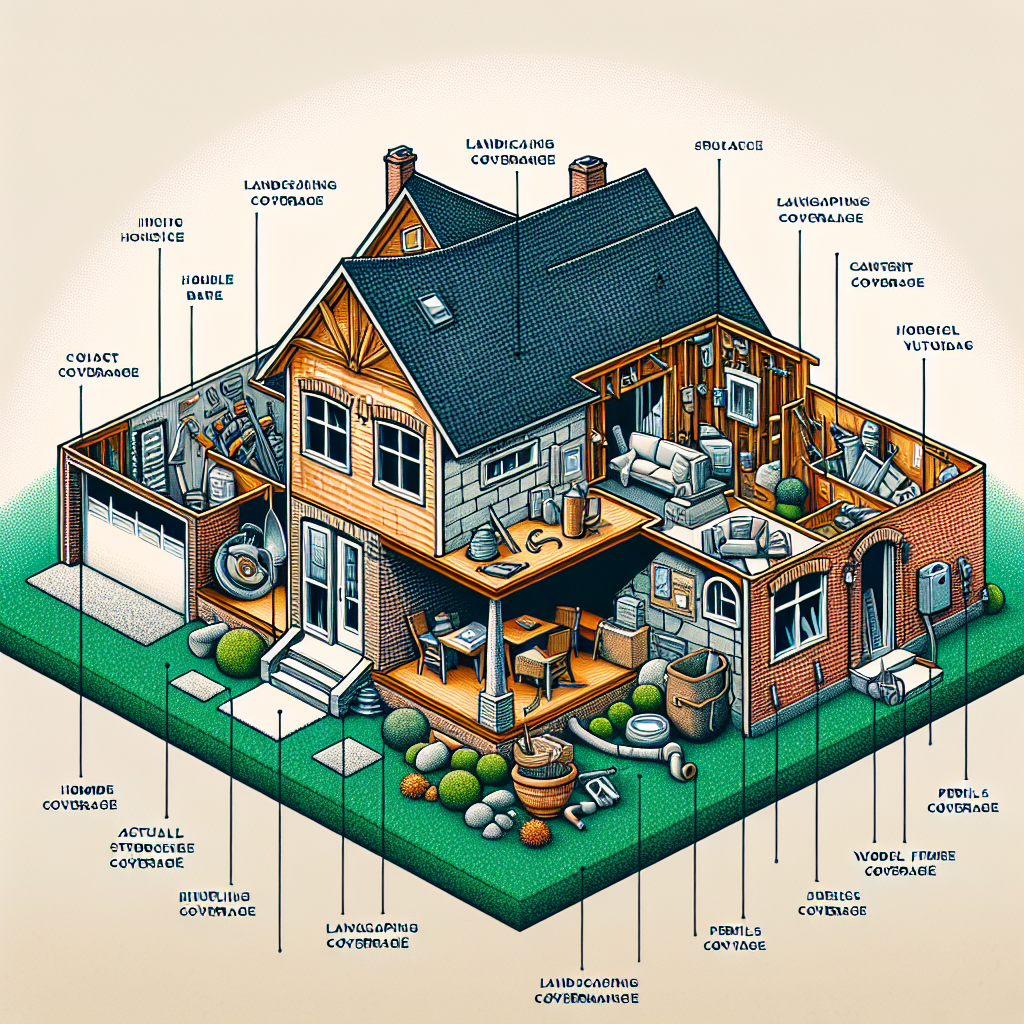

If you own a home, you already know the insurance basics: dwelling, personal property, and liability. What often gets missed are the small-but-expensive gaps that surface after a claim—code upgrades, service line failures, water backup, or breakdowns of major systems. That’s where USAA Insurance Home Protector Coverage enters the conversation. Think of it as a strategic enhancement to a standard homeowners policy, designed to widen key protections so you’re not left piecing together expensive fixes when life gets messy.

What Is USAA Insurance Home Protector Coverage?

At its core, this is an add-on (also called an endorsement or package) offered to eligible USAA members that broadens the safety net of a conventional homeowners policy. While standard homeowners insurance covers common losses like fire or wind, there are many situations that either fall into gray areas or exceed standard limits. USAA Insurance Home Protector Coverage is meant to help address those blind spots with increased sub-limits, expanded causes of loss, and extra benefits that can make rebuilding and recovery easier.

Key note: The exact features, limits, and availability of this coverage differ by state and policy form. Always review your declarations page and speak with a USAA representative to understand what applies to your home.

Why Homes Need More Than “Basic” Coverage

Construction costs have been volatile in recent years, driven by labor shortages, supply chain swings, and severe weather events. Industry analyses from sources such as the Insurance Information Institute and Verisk have highlighted the trend: rebuilding a home after a loss is often more expensive and slower than many homeowners expect. At the same time, water damage claims—from aging plumbing and extreme rainfall—are frequent and costly, and building codes continue to evolve, requiring pricier materials and methods after a major loss.

Against this backdrop, an upgrade package that helps with higher costs, expanded protection (especially around water and equipment), and better post-loss support can be the difference between a manageable setback and a financial shock.

What USAA Insurance Home Protector Coverage Often Includes

Every insurer builds these packages differently, and USAA may vary by jurisdiction. However, the following features are commonly associated with a home protector–style endorsement. Treat this as a framework to ask better questions when you quote or review your policy.

1) Dwelling Enhancements

- Extended replacement cost: Helps pay for rebuilding your home if construction costs run higher than your dwelling limit after a covered loss. This can be crucial in years when material and labor prices surge.

- Ordinance or law coverage: Pays for required code upgrades when you repair or rebuild, such as electrical panel updates, stairway changes, or energy-efficiency standards. Without this, you could be on the hook for costly compliance work.

- Debris removal and tree removal boosts: Increased allowances for hauling away debris, fallen trees, and damaged materials after a storm or fire.

- Inflation guard: Periodic adjustments that help your dwelling limit keep pace with construction inflation over time.

2) Personal Property Upgrades

- Replacement cost on contents: Pays to replace items with new ones of like kind and quality, rather than depreciated value. This matters significantly for electronics, furniture, and appliances.

- Higher special limits: Many standard policies cap payouts for categories like jewelry, tools, firearms, or collectibles. A protector endorsement may raise some of these internal limits. For high-value items, consider scheduled coverage or a separate valuable personal property policy.

- Refrigerated property: Limited coverage for food spoilage due to covered power loss or equipment failure.

3) Water-Related Protections

- Water backup and sump overflow: An optional upgrade in many states, this can cover damage from backed-up drains, sump pump failures, or sewer lines—events typically excluded in base policies.

- Service line coverage: Helps pay to repair or replace buried utility lines you own (such as water, sewer, or power) between the street and your home if they leak, break, or short-circuit due to covered causes.

4) Equipment Breakdown

- Coverage for sudden mechanical or electrical breakdown of home systems and appliances, like HVAC units, boilers, and built-in electronics. It’s not a maintenance plan, but it can step in when a system fails abruptly due to covered internal failure.

5) Loss of Use Enhancements

- Additional living expense increases: If a covered loss makes your home uninhabitable, higher limits for temporary housing, meals, and related costs can provide meaningful breathing room during repairs.

6) Liability and Personal Injury Options

- Higher liability limits: More protection if someone is injured on your property or if you accidentally cause property damage to others.

- Personal injury endorsement: In some states, coverage can extend to claims like libel or slander. Verify availability and scope with USAA.

7) Identity Theft and Cyber Support

- Identity theft recovery services: Assistance and limited reimbursement for expenses tied to identity fraud, such as lost wages for time spent resolving issues and fees for document replacement.

Again, check your policy details. Some of these protections might be included in USAA Insurance Home Protector Coverage, while others may be separate add-ons you can bundle for a comprehensive package.

What It Usually Doesn’t Cover

Endorsements can enhance your policy, but they don’t rewrite the fundamentals. Common exclusions still apply:

- Flood: Requires a separate flood policy (often through the NFIP or a private market). If you live in a flood-prone area, consider this essential.

- Earthquake: Typically needs a distinct endorsement or standalone policy, depending on your state.

- Wear and tear and maintenance: Rust, mold from ongoing leaks, or deferred maintenance aren’t covered.

- Intentional loss or illegal activity: Always excluded.

- Certain types of water damage: Groundwater seepage or long-term leakage may still be excluded without specific endorsements.

If in doubt, ask your agent how USAA Insurance Home Protector Coverage interacts with your base policy’s exclusions so you know where the edges are.

Eligibility and Membership Considerations

USAA membership is generally available to active, retired, and honorably separated members of the U.S. military and their eligible family members. Because the company serves a specific community, rates, discounts, and coverage packages are built with the needs of military families in mind. Availability of any particular endorsement can vary by state and property type (single-family, condo, rental, etc.), and underwriting approval is required.

How Much Does It Cost?

Pricing depends on your home’s location, age, square footage, roof condition, claim history, deductibles, and the exact bundle you choose. Adding USAA Insurance Home Protector Coverage typically increases your premium, but the cost-to-benefit ratio can be attractive when you consider real-world claim expenses like code upgrades or service line repairs.

Ways your price may be influenced:

- Higher deductibles usually reduce premium, but make sure you can comfortably afford the out-of-pocket cost if you file a claim.

- Bundling home and auto and installing security or mitigation devices (monitored alarms, smart leak sensors, automatic water shut-off valves) may qualify for discounts.

- Roof updates, wind mitigation features, and fire-resistant materials can lower risk and cost in many states.

Do You Really Need It? A Practical Checklist

Consider adding a home protector–style endorsement if any of the following apply:

- Your home is older and likely to require code upgrades during a rebuild.

- You’ve recently renovated with custom finishes or premium materials.

- Your area has frequent heavy rains, aging infrastructure, or tree-lined lots that increase water backup and service line risks.

- You rely heavily on HVAC and major built-in systems, making equipment breakdown coverage appealing.

- You want higher sub-limits on categories where standard policies cap payouts.

If several of these resonate, USAA Insurance Home Protector Coverage can be a smart, cost-effective way to strengthen your financial resilience.

Real-World Scenarios Where It Can Help

- Windstorm with code upgrades: A severe storm tears off a portion of your roof, damaging rafters. Local code now requires upgraded materials and a different underlayment. Ordinance or law coverage can help pay for those mandated changes beyond the simple replacement of what you had.

- Basement water backup: A sudden storm overwhelms sewers and your sump pump can’t keep up. Water backs into the basement, ruining flooring and stored items. Water backup coverage—if included or added—can help with cleanup and replacement.

- HVAC failure in a heat wave: Your central AC suffers a mechanical breakdown and needs a costly compressor replacement. Equipment breakdown coverage may step in when a standard policy wouldn’t.

- Service line collapse: A tree root crushes your sewer line near the street. Without service line coverage, digging and replacement could run thousands out of pocket. With it, you could be covered up to your endorsement’s limits, subject to deductible.

- Extended displacement after a fire: Fire damages the kitchen and smoke affects the entire first floor. Additional living expense enhancements help cover temporary housing and meals while your home is professionally cleaned and repaired.

How Claims Typically Work

When a loss occurs, speed and documentation matter. Here’s a simple playbook:

- Ensure safety first: Evacuate if needed. Shut off water or electricity if safe to do so.

- Prevent further damage: Temporary tarps, water shut-off, or emergency services are often required to avoid additional loss.

- Document everything: Take photos and videos, save receipts for emergency repairs, and keep a log of conversations with vendors.

- Report promptly: Contact USAA to start the claim and clarify whether your loss triggers protections under your base policy or enhancements.

- Meet the adjuster: Walk through damage, share your documentation, and ask how any endorsements (like ordinance, water backup, or equipment breakdown) apply.

- Track estimates: Compare contractor quotes. Ask if local code requirements will affect timelines and budgets.

Pre-Loss Prep That Pays Dividends

- Create a digital home inventory: Photos, serial numbers, and receipts in cloud storage can accelerate claim payments.

- Install mitigation devices: Leak sensors, water shut-off valves, and monitored alarms reduce loss frequency and may unlock discounts.

- Maintain major systems: Annual HVAC service, roof inspections, and cleaning gutters help prevent maintenance-related issues that policies won’t cover.

- Review your coverage annually: Renovations, new valuables, or local code changes should prompt a policy review.

How It Compares to Other Insurers’ Enhancements

Many carriers now offer a “plus,” “advantage,” or “enhanced” home package with similar goals: reduce coverage gaps and raise important sub-limits. Differences typically show up in the fine print—how generous the extended replacement cost is, whether service lines are included by default or optional, the scope of equipment breakdown, and the extent of water backup coverage. If you’re shopping, line up the details side by side and pay special attention to exclusions, sub-limits, and deductibles.

USAA Insurance Home Protector Coverage fits into this broader market trend by packaging high-impact upgrades in one place. For military families who move more often or own homes in diverse climates, having a well-rounded endorsement can provide consistent peace of mind.

Current Trends Shaping Home Insurance Decisions

- Inflation and supply chain volatility: Building costs may continue to fluctuate, making extended replacement cost and inflation guard valuable.

- Water damage frequency: Insurers consistently report high claim volume from non-weather water losses (pipe bursts, appliance leaks). Water backup and leak mitigation are high-impact areas.

- Aging infrastructure: As neighborhoods mature, service line failures become more common, and repairs cost more than many homeowners expect.

- Severe weather and resilience: Stronger storms can intensify demand for debris removal, tree removal, and code upgrades.

- Smart home adoption: As connected devices proliferate, equipment breakdown and cyber/ID assistance have gained relevance.

Industry experts often emphasize that underinsurance remains widespread. Assessing replacement cost accurately and closing common gaps with bundled enhancements can mitigate that risk.

Frequently Asked Questions

Does this coverage include flood or earthquake?

No. Flood and earthquake typically require separate policies or endorsements. Ask USAA about availability in your state.

Is water backup automatically included?

It may be included or optional depending on your state and package. Verify limits and whether sump overflow is covered, as those details matter in real claims.

What about home-sharing or short-term rentals?

Renting out part or all of your home can change your risk profile. Some policies need additional endorsements for home-sharing exposures. Discuss specifics with USAA before listing your property.

How are high-value items covered?

Even with higher sub-limits, categories like jewelry or fine art may still need separate scheduling for full protection. Ask about appraisals and agreed value options.

Will my premium go up if I add this?

Likely yes, but you’re buying broader protection. Compare the added premium to potential out-of-pocket costs for code upgrades, water backup, or a service line dig.

What deductible should I choose?

Pick a deductible you can comfortably pay in an emergency. Some homeowners choose a higher deductible to keep premiums manageable, then use savings to fund mitigation devices.

Can I add or remove certain features?

Often, yes. Elements like water backup or equipment breakdown can be optional. Tailor your package to the risks your home actually faces.

How to Add or Review USAA Insurance Home Protector Coverage

- Audit your risks: Consider your home’s age, location, plumbing and electrical systems, and recent renovations.

- Gather info: Square footage, roof age, updates, and any recent claims help produce an accurate quote.

- Call or log in: Review your current policy and ask a USAA representative to explain what the protector package includes in your state.

- Compare options: Ask for quotes with and without specific add-ons (water backup, service line, equipment breakdown) and compare the premium differences.

- Right-size limits: Ensure your dwelling limit reflects current rebuild costs and that sub-limits align with your property and lifestyle.

- Document decisions: Save your updated declarations and endorsement forms in a secure digital folder.

Smart Ways to Save While Strengthening Coverage

- Mitigation first: Install automatic water shut-off valves, leak sensors, and monitored smoke/CO detectors. They lower loss risk and may reduce premiums.

- Roof and drainage: Maintain gutters, add gutter guards where appropriate, and check grading to keep water away from your foundation.

- Update electrical and plumbing: Proactive upgrades can reduce claims and may improve your insurability.

- Bundle and loyalty: Explore multi-policy savings and ask about credits for monitored security systems.

- Annual review: Reassess limits after renovations or major purchases to avoid underinsurance.

The Bottom Line

Home insurance is about more than meeting your mortgage requirement—it’s about ensuring you can rebuild your life after a loss without crippling surprises. By targeting common pain points like code upgrades, water backup, service lines, and system breakdowns, USAA Insurance Home Protector Coverage helps bring your policy closer to the realities homeowners face today.

Start with a clear picture of your home’s risks, then customize the package to match. Ask pointed questions, verify limits and exclusions, and confirm what’s included in your state. With the right blend of coverage, maintenance, and mitigation, you can protect your largest asset with confidence—and sleep a little easier when the forecast turns stormy.